The #Paytm Saga – When Geniuses failed.

Paytm, the leading Fintech, has been a case for mass destruction despite as a product; it is no doubt that the Founder of Paytm, Vijay Shekhar Sharma’s view, was ahead of time. But interestingly, the stock has been eye candy for traders and investors who always look to pull the trigger on this stock. Be […]

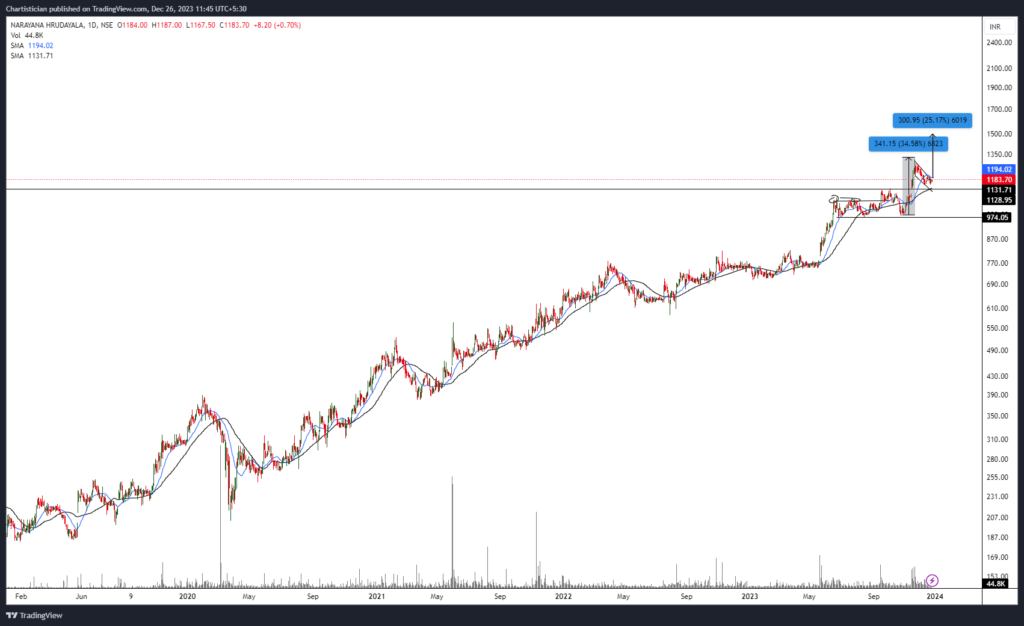

Narayana Hrudayalaya – 20% Upside?

NH is retracing for a Dip further to extend the bullish rally to the new ATH. The chart structure is a classic example of how stock consolidates and moves out to break and how previous resistance becomes support. After the breakout from a rectangular pattern, the stock rallied towards 1,300 odd levels and, at present, […]

Railway Stocks and IRFC.NSE / IRFC

This one stock has probably made many some good amount of money(including our clients and myself) and has given many the worst feeling one can have in the market; the F.O.M.O. Yes, The Fear Of Missing Out is one decision that brings in regret which is not addressed in even behavioral finance and at the […]

SBIN – The Leader of PSUs

SBIN.NSE, State Bank of India, one of the largest and leading PSU banks, has recently given a breakout on weekly and daily scales, indicating the current bullish run would have it as one of the leaders. The breakout above 621, Gap Up, Volumes, ADX, and all other variables indicate this to sustain in the coming […]

Stock Analysis – Cochin Shipyard, cochinship.nse

A new bullish leg in Cochin Shipyard is visible as the stock prices form a saucer pattern. The saucer pattern, a rounding bottom, is a technical analysis pattern resembling a “U” on a price chart. It signifies a gradual transition from a downtrend to an uptrend in an asset’s price. This pattern suggests a reversal […]

Nifty 50 – “Never Short a Dull Market”!

The outlook on the Nifty 50 Index stands very straight with no BS. It is Bullish. The RSI – Momentum On the Daily timeframe, RSI is above the 80 mark. No, it’s not overbought; it indicates a thrust in the price action on the upside based on its recent AVG gains, which outweighed the average […]

Why must your Analyst be SEBI Registered?

Having a SEBI-registered analyst is crucial for several reasons: In summary, having a SEBI-registered analyst ensures regulatory compliance, promotes investor protection, enhances market credibility, and contributes to ethical and transparent practices within India’s financial markets. It’s a critical step toward ensuring professionalism, credibility, and trust in financial advice and recommendations provided to investors.

Can short-term trading generate income?

Yes, short-term trading has the potential to generate income, but it comes with both opportunities and risks. Short-term trading involves buying and selling financial instruments within a relatively brief period to profit from short-lived market movements. Traders employing this strategy often focus on capturing quick price fluctuations, leveraging volatility to generate income. The advantages of […]

What is Short term Trading?

Short-term investing is a strategy wherein individuals seek to capitalize on market opportunities over a brief period. Unlike long-term investments that focus on assets held for years or decades, short-term investing involves a more active approach, aiming for quick profits within a shorter time frame, often spanning from days to a few months. In short-term […]