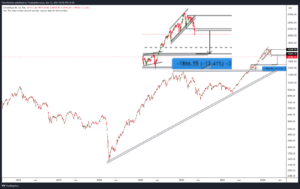

A new bullish leg in Cochin Shipyard is visible as the stock prices form a saucer pattern. The saucer pattern, a rounding bottom, is a technical analysis pattern resembling a “U” on a price chart. It signifies a gradual transition from a downtrend to an uptrend in an asset’s price. This pattern suggests a reversal of the previous downward trend and typically indicates a bullish sentiment in the market. Traders often look for increased volume and a breakout above the saucer’s rim to confirm the pattern before making trading decisions.

The stock has undergone this overdue consolidation since early September 23 and is coming out with a visible breakout. The volume participation in the latter stages of the pattern has seen a jump while, at the same time, the price is now sustaining the breakout point or, as technical analysis says, the point of polarity. Thi makes the reward risk favorable for short-term/Pattern traders.

ADX, RSI, and the Volume

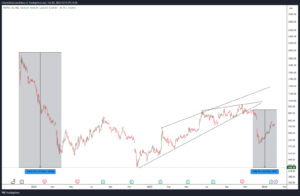

Traders often use ADX to determine the strength of a trend and its potential for continuation or reversal. When combined with other indicators, ADX helps traders decide about entering or exiting trades. For instance, a rising ADX might indicate a strengthening trend. ADX is positive on a rolling basis and is currently at 38.54, indicating price strength may continue in the mid-to short-term.

RSI on the weekly chart has crossed above 70 levels, indicating good momentum as the RSI might stay in overbought or oversold territory for extended periods during solid trends. At the same time, volume at the breakout point confirms the current price action.

In the short to mid-term, We expect CochinShipyard to continue the uptrend. It is currently trading at 1274 – 1270. A dip towards 1200 can be used. A close below 1215 will negate this view. Based on the pattern, an upside projection comes at 1560 – 1670, making the reward risk 6:1.

It is worth the risk.