This one stock has probably made many some good amount of money(including our clients and myself) and has given many the worst feeling one can have in the market; the F.O.M.O. Yes, The Fear Of Missing Out is one decision that brings in regret which is not addressed in even behavioral finance and at the same time, FOMO overshadows logic and pressurizes people to take a decision which is not rational. At least at that point in time.

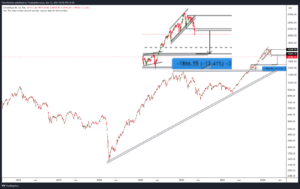

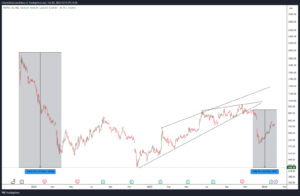

Anyway, coming back to our stock, The IRFC has given a breakout (as it has been giving month after month), and the recent one is just a bit fresh. Our analysis in the chart below depicts the same and obviously states the point: Is it that simple?

Three things to notice, and we’ ‘ll share that with you.

1 – Price – The price moves up, but before moving up, it gives a breakout. We can call it 10 Day/20 Day or 52 Week or ATH breakout. But, the point here is that price retraces to all these barriers pretty quickly after a good consolidation and begins a new trajectory. The classic characteristic of a Trend following stock.

2 – ADX – In a trending stock, ADX crossing above 25 on a rolling basis is one event that makes it attractive (and this is a daily chart; on a weekly basis, it’s all different scenarios). Whenever it passes above 25 and the price breaks either of the barriers, it sustains above the 25 level for a sustained period of time, indicating the high velocity in the underlying trend.

3 – Gaps – Notice that recently and in the past, A gap is usually seen, and price indicates that this void is a function of some activity, which may be volume, some news, or whatever Eeny, meeny, miny, moe we can attribute it. A gap on a breakout is definitely a signal that we should keep a close watch on.

Yes. I know. The Volume, The moving average, and all I can put in the chart, make it more fancy, and add more indicators is not our cup of tea.

From here, IRFC may turn out to be in three digits ( No Not 100), which may be beyond that and it is definitely a stock worth keeping in the watchlist.

Recent Support at 91 – 92 provides a Valid Stop for an upside momentum.

#irfc #trading #nifty50 #railwaystocks