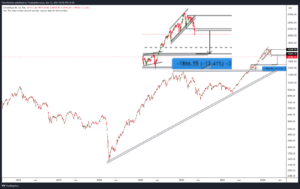

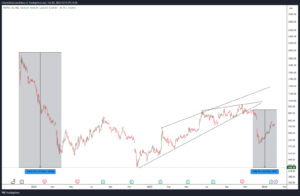

SBIN.NSE, State Bank of India, one of the largest and leading PSU banks, has recently given a breakout on weekly and daily scales, indicating the current bullish run would have it as one of the leaders. The breakout above 621, Gap Up, Volumes, ADX, and all other variables indicate this to sustain in the coming days, and this bank can give us an upside towards much higher levels(We don’t guess targets in trend following!)

Volume – The volume activity has increased recently and is above average; 10 Period Volume MA continues to slant upward. Though it is not necessary to continue its upward trend in terms of participation at the point of breakout, we have witnessed some good participation.

Rising ADX – ADX is a trend strength Indicator indicating the velocity in underlying prices. The Rise in ADX has been sharp and above the traditional 25. This further adds to the weight of the evidence.

The Price (Yeah, yeah, it is the god) – Lastly, Buying a stock at the breach of the 52-week high is a simple trend following and has been known to produce efficient results( I have backtested it so that I can say). A 2.5ATR SuperTrend can work as a Stoploss on a Weekly timeframe.

Position Sizing – Well, To each his own, as Douglas said in “Trading in the Zone,” but we would recommend having a 5|% exposure to this stock in the portfolio.