Introduction After several sessions of steady upward movement, Indian equities showed visible signs of fatigue on October 24, as both Nifty 50 and Bank Nifty encountered selling pressure at higher levels. Traders booked profits near resistance zones, leading to a mild correction. Despite this short-term weakness, both indices remain comfortably above their key moving averages, indicating that the broader structure is still bullish. In this Trade Setup for 27 October 2025, dhwani patel, SEBI registered research analyst, analyzes the Nifty and Bank Nifty levels, options data, and key setups to help traders plan their strategy for the upcoming session. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,795 Market Outlook:Nifty formed a long bearish candle with a small lower wick, indicating sustained selling pressure. This price action broke the six-day higher-high pattern visible on the daily chart, although the weekly trend remains upward. Momentum indicators show early signs of cooling. The RSI slipped to 67.92, and the Stochastic RSI triggered a bearish crossover — implying fatigue in momentum. However, the MACD remains on a positive crossover with the histogram still above zero, confirming that the larger uptrend remains intact. Interpretation: For those following the Nifty futures trading guide, traders can stay cautiously bullish with tight stop-losses below 25,590. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 57,700 Market Outlook:After touching a record high, the Bank Nifty reversed to form a bearish candle with a lower wick — reflecting intraday volatility and ongoing profit-booking. The pattern shows a lower high–lower low formation, signaling short-term exhaustion after a strong run-up. Momentum is fading slowly. The RSI near 68.69 is approaching a support zone, while the Stochastic RSI has entered a bearish crossover. Despite this, the MACD remains positive and key moving averages continue to slope upward. Interpretation: For traders using index futures trading strategies India, dips near 57,400 remain ideal accumulation points for positional setups. Setup 3 — Nifty Call Options Data Interpretation:Call writers are aggressively defending 26,000–26,500, indicating a strong supply zone. This range will remain a key hurdle for Nifty unless it breaks out with volume and momentum. Setup 4 — Nifty Put Options Data Interpretation:Strong Put buildup near 25,700–25,800 suggests buyers are defending this zone actively. As long as these levels hold, downside risk remains limited. Setup 5 — Bank Nifty Call Options Data Interpretation:Profit-booking was visible in higher strikes, with fresh writing around 58,000–59,000. These levels will likely cap upside unless momentum returns with strong volumes. Setup 6 — Bank Nifty Put Options Data Interpretation:Put writers remain active near 57,000, confirming that traders are still betting on the continuation of the bullish structure. Setup 7 — Put-Call Ratio (PCR) Nifty PCR: 0.76 (down from 0.95) A falling PCR signals short-term caution as Call writing has increased. However, the ratio is still above oversold territory, implying consolidation rather than outright weakness. Setup 8 — India VIX India VIX: 11.59 (–1.21%) Volatility eased slightly and remains well within the bullish comfort zone. As long as VIX trades below 13, markets are unlikely to see major disruptions. As dhwani patel explains,“Low volatility hides the best trading setups — they emerge quietly while others wait for noise.” Setup 9 — Intraday Playbook Index Bullish Above Bearish Below Neutral Zone Nifty 50 25,906 25,680 25,750–25,850 Bank Nifty 58,092 57,341 57,500–57,900 Strategy: Setup 10 — dhwani patel’s View “Short-term pullbacks are part of strong trends. The key is to differentiate between profit booking and panic — markets often test your patience before rewarding it.” The Trade Setup for 27 October 2025 signals short-term consolidation within a larger bullish framework. Traders should monitor 25,700 on Nifty and 57,300 on Bank Nifty as crucial zones to gauge market direction. Key Takeaways Final Thoughts Markets are adjusting after a record run-up — a natural and necessary phase for sustainable momentum.For traders and investors following index futures trading strategies India, the focus should remain on managing exposure, respecting key supports, and letting the broader trend guide decision-making. As dhwani patel concludes: “Every correction tests conviction. The strongest hands stay steady while the weak hands seek certainty.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The views expressed are educational in nature and not investment recommendations. Trading in financial markets involves risk. Please conduct your own research before making any investment or trading decision.

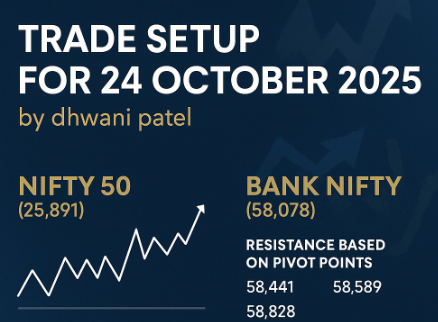

Trade Setup for 24 October 2025 by dhwani patel

Introduction After a week of steady gains and fresh record highs, the Indian markets showed signs of mild fatigue on October 23, as traders booked profits near the top. Both Nifty 50 and Bank Nifty witnessed intraday volatility, but the overall trend remains bullish — supported by rising moving averages, stable global cues, and consistent institutional inflows. In this Trade Setup for 24 October 2025, dhwani patel, SEBI registered research analyst, breaks down the key Nifty and Bank Nifty levels, along with option data, volatility trends, and 10 actionable setups to help traders plan their positions effectively. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,891 Market Outlook:Nifty formed a bearish candle with a small upper wick, indicating some selling at higher zones. However, the higher high–higher low pattern remains undisturbed — a sign that the uptrend is still healthy. The index continues to trade comfortably above all key moving averages, and momentum indicators like the RSI (in the 60–70 range) and a rising MACD suggest that underlying strength persists despite short-term consolidation. Interpretation: For traders following a Nifty futures trading guide, it’s a classic continuation phase — not an exit zone, but a time for patience and risk management. Setup 2 — Bank Nifty: Pivot & Fibonacci Levels Bank Nifty Close: 58,078 Market Outlook:Bank Nifty briefly surpassed 58,500, recording a new all-time high before encountering resistance. The day’s candle reflects selling pressure at intraday highs, but the broader uptrend remains fully intact. Moving averages continue their upward slope, and the RSI, elevated near 76, confirms strong momentum. The MACD also supports the positive trend, showing no early signs of reversal. Interpretation: For those applying index futures trading strategies India, this setup favors tactical longs on intraday declines, with tight stop-loss placement below 57,600. Setup 3 — Nifty Call Options Data Analysis:Aggressive call writing above 26,000 indicates cautious optimism — traders are booking gains near upper levels. The 26,200–26,500 range may act as a short-term ceiling unless fresh momentum emerges. Setup 4 — Nifty Put Options Data Analysis:Active Put writing around 26,000 shows confidence among buyers. As long as these strikes hold, the broader sentiment remains constructive, even amid mild corrections. Setup 5 — Bank Nifty Call Options Data Analysis:Call writers are defending 58,500–58,800, signaling potential near-term resistance. A breakout above this zone could lead to short-covering, propelling prices toward 59,500–60,000. Setup 6 — Bank Nifty Put Options Data Analysis:Put writers remain active near 58,000 — a sign of confidence that the index will not see a deep correction in the immediate term. Setup 7 — Volatility Index (India VIX) India VIX: 11.73 (+3.85%) The VIX rose modestly, reflecting a slight uptick in uncertainty after a smooth rally. While current levels remain manageable, traders should be cautious if volatility sustains above 13–14 in the coming sessions. As dhwani patel emphasizes,“Volatility doesn’t end bull markets — it just resets trader confidence.” Setup 8 — Sectoral Rotation Watch For swing trading strategies India, aligning with sectoral leadership continues to offer the best risk-reward setups. Setup 9 — Intraday Trade Plan Index Bullish Above Bearish Below Neutral Zone Nifty 50 26,045 25,803 25,850–26,000 Bank Nifty 58,589 57,815 58,000–58,400 Strategy: Setup 10 — dhwani patel’s View “After a sustained run, short-term profit booking is natural — but trend traders should not confuse pauses with reversals. As long as Nifty stays above 25,800 and Bank Nifty above 57,800, the market retains its bullish tone.” The Trade Setup for 24 October 2025 signals consolidation within strength. Momentum remains intact, and dips continue to offer opportunities to align with the broader trend. Key Takeaways Final Thoughts The market is digesting its gains — not reversing. Traders should focus on managing exposure, protecting profits, and letting the trend evolve naturally. As dhwani patel aptly says — “The best traders don’t chase moves — they prepare for them. Control your risk; the market will handle the rest.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information provided is for educational purposes only and does not constitute investment or trading advice. Trading in financial markets carries risk. Readers should perform their own analysis.

Trade Setup for 23 October 2025 by dhwani patel

Introduction After a strong uptrend over the past sessions, the Indian markets paused slightly on October 22, with both Nifty 50 and Bank Nifty facing mild profit-booking near their respective highs. Despite the minor cooling off, both indices continue to show a powerful underlying structure supported by strong moving averages and momentum indicators. In this Trade Setup for 23 October 2025, dhwani patel, SEBI registered research analyst, outlines the exact Nifty and Bank Nifty levels, along with 10 structured setups that capture the market’s short-term psychology and opportunities for the day. ⚙️ Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,869 Special Formation:The Nifty 50 formed a bearish candle with minor upper and lower shadows, reflecting mild volatility near the highs. Yet, the index continues to trade at the upper Bollinger Band, showcasing strong price momentum. All key moving averages remain upward sloping, indicating sustained trend strength. The RSI stands elevated at 72.26, while the MACD maintains a strong upward crossover with an expanding histogram — evidence that bullish momentum remains dominant despite minor cooling. Interpretation: For traders using a Nifty futures trading guide, the market remains buy-on-dips oriented, with focus on trailing stops instead of initiating fresh shorts. ⚙️ Setup 2 — Bank Nifty: Pivot & Fibonacci Levels Bank Nifty Close: 58,007 Special Formation:The Bank Nifty traded near the upper Bollinger Band, forming a small bearish candle within the previous day’s range — a sign of consolidation rather than reversal. The index remains firmly in an uptrend, with RSI at 76.17 and MACD maintaining its bullish trajectory. The higher top–higher bottom formation continues to confirm buyers’ dominance. Interpretation: This setup remains favorable for index futures trading strategies India focusing on long continuation plays in banking names. ⚙️ Setup 3 — Derivatives & Option Chain Analysis Nifty Call OI: 25,900, 26,000Nifty Put OI: 25,800, 25,700 Bank Nifty Call OI: 58,000, 58,500Bank Nifty Put OI: 57,800, 57,500 Interpretation:Options data suggests consolidation with a bullish tilt. Strong put writing near 25,800 and 57,800 indicates firm support zones.If both indices hold above these levels, we may witness another short-covering push toward upper resistance zones. ⚙️ Setup 4 — Market Sentiment & PCR The Put-Call Ratio (PCR) for Nifty hovers near 1.18, signaling mild bullish sentiment.Market positioning shows steady optimism, but traders should monitor for a sharp PCR rise above 1.3, which often precedes near-term cooling. For now, sentiment remains solid, with dips viewed as opportunities to add positions. ⚙️ Setup 5 — Volatility Outlook India VIX remains calm at around 10.4, indicating low fear levels.Low volatility supports trend-following setups, but it can also precede breakout volatility. As dhwani patel notes,“Complacency in low VIX phases is a trader’s trap — when volatility wakes up, it rarely knocks first.” Maintain defined stop-losses even in trending markets. ⚙️ Setup 6 — Sectoral Focus For swing trading strategies India, look for stock setups aligning with sector leaders rather than laggards. ⚙️ Setup 7 — Technical Snapshot Summary Index Candle Type RSI MACD Trend Bias Outlook Nifty 50 Bearish (minor) 72.26 Bullish Uptrend Positive Bank Nifty Bearish (inside bar) 76.17 Bullish Strong Uptrend Very Positive Both indices show signs of consolidation within strength.The RSI nearing overbought levels suggests the need for patience and position scaling rather than fresh aggressive longs near resistance. ⚙️ Setup 8 — Global Cues & Institutional Flow Global stability coupled with local institutional support continues to drive positive undertone for the Indian market. ⚙️ Setup 9 — Intraday Trade Plan Index Bullish Above Bearish Below Neutral Zone Nifty 50 25,918 25,809 25,835–25,900 Bank Nifty 58,183 57,851 57,900–58,100 Trading Strategy: Maintain caution around midday volatility and expiry-related adjustments. ⚙️ Setup 10 — dhwani patel’s View “Momentum may appear overextended, but strength within consolidation defines bull markets. Until key supports are breached, traders should respect the trend rather than resist it.” The Trade Setup for 23 October 2025 signals a continuation of bullish control with intermittent consolidation.As long as Nifty holds above 25,800 and Bank Nifty above 57,800, dips remain healthy and tradable. ⚠️ Key Takeaways Final Thoughts The uptrend remains intact, with short-term consolidation adding sustainability to the rally. Market breadth is firm, volatility is controlled, and institutional flows stay supportive. As dhwani patel puts it — “Discipline is your defense in record markets. The goal is not to predict the top but to protect your capital when it arrives.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information shared here is purely educational and does not constitute investment advice. Trading and investing involve risk. Readers should conduct independent research.

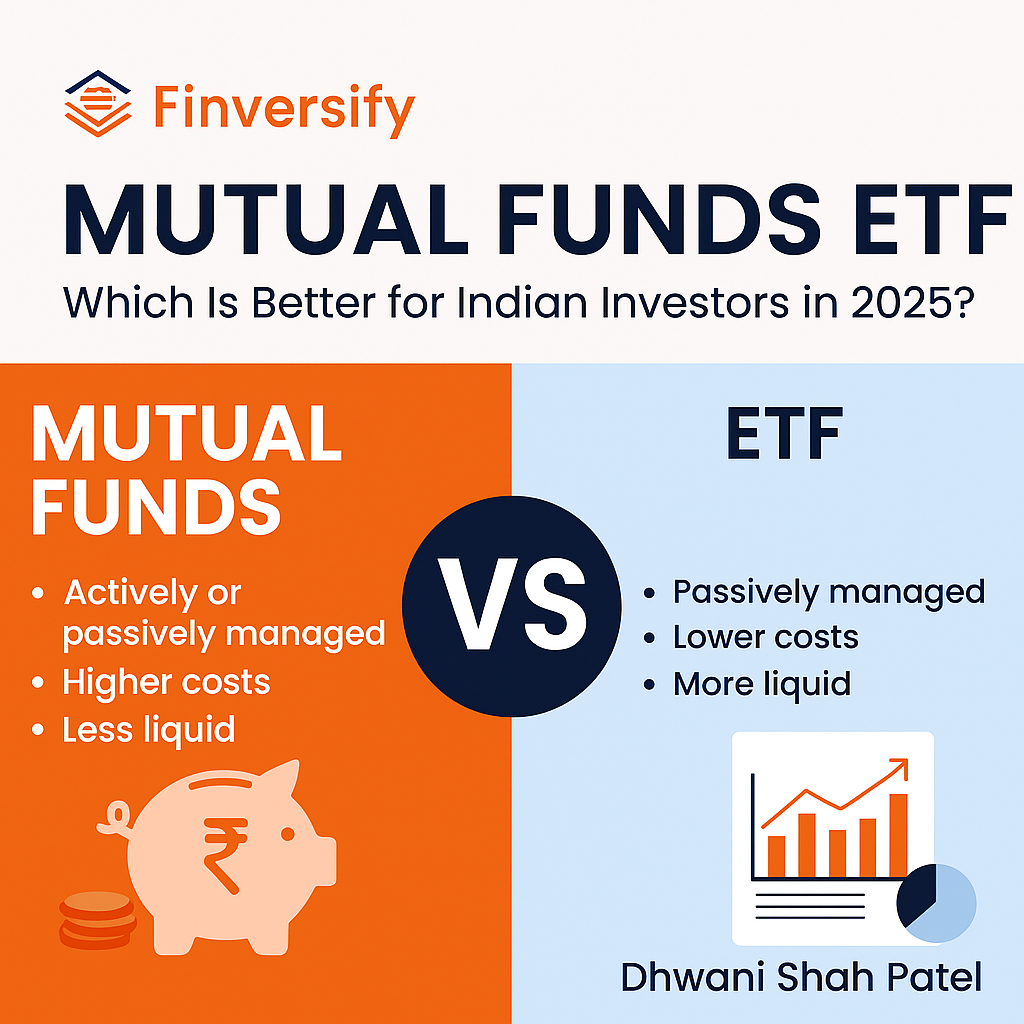

Mutual Funds Versus ETF: Which Is Better for Indian Investors in 2025?

Introduction When it comes to long-term wealth creation, mutual funds and exchange-traded funds (ETFs) are two of the most popular choices among Indian investors. Both allow diversification across sectors and assets, both are professionally managed, and both have the potential to compound wealth steadily. But there’s a catch — while they may look similar, mutual funds versus ETFs differ significantly in structure, cost, and trading style. Choosing the right one depends on your goals, risk appetite, and how actively you want to manage your money. In this guide, Dhwani Shah Patel from Finversify breaks down the difference between mutual funds and ETFs, their advantages, drawbacks, tax treatment, and which works better for investors in 2025. What Are Mutual Funds? A mutual fund pools money from many investors and invests in a portfolio of stocks, bonds, or other securities. It’s managed by professional fund managers under an Asset Management Company (AMC). There are two broad categories: Key features: What Are ETFs (Exchange-Traded Funds)? An Exchange-Traded Fund (ETF) also pools investor money but trades like a stock on exchanges (NSE/BSE). Most ETFs are passively managed, tracking an index, commodity, or sector. Example: Nifty 50 ETF, Gold ETF, Bharat 22 ETF. Key features: Mutual Funds vs ETFs — A Side-by-Side Comparison Feature Mutual Funds ETFs Management Style Active or Passive Mostly Passive Buying / Selling Through AMC or online platforms; once per day On stock exchanges throughout trading hours Pricing Based on end-of-day NAV Market price fluctuates during the day Minimum Investment ₹500 (SIP) 1 unit (price varies by ETF) Expense Ratio Higher (1–2.25%) Lower (0.05–0.75%) Liquidity Moderate; units redeemed at NAV High (depends on trading volume) Transparency Portfolio disclosed monthly Portfolio visible daily Taxation Similar to ETFs (equity vs debt classification) Similar to mutual funds (depends on type) Best Suited For Long-term, goal-based investors Active traders or low-cost passive investors The Cost Factor — Expense Ratio and Hidden Charges The expense ratio directly affects returns. Over time, this small percentage difference compounds heavily. Example:Invest ₹10 lakh for 15 years at 12% CAGR. However, ETFs involve brokerage fees and bid-ask spreads when buying/selling — small but real costs to factor in. Liquidity & Trading Flexibility Mutual fund transactions are simple — you place a buy or sell request and get NAV-based execution at day-end. ETFs, by contrast, trade like any stock: 💡 Pro Tip from Dhwani Shah Patel:For long-term wealth building, frequent ETF trading isn’t necessary. Stick to a systematic investment plan (SIP) in index funds or periodic ETF accumulation. Transparency & Control ETFs win big on transparency. Mutual funds disclose holdings monthly, and investors have to trust the fund manager’s decisions in between. If you prefer control and real-time access, ETFs are better.If you prefer hands-off management, mutual funds are more convenient. Taxation: Mutual Funds vs ETF Both are taxed similarly under Indian laws: Type Holding Period LTCG STCG Equity Funds / ETFs > 1 year 10% above ₹1 lakh 15% Debt Funds / ETFs 3+ years 20% with indexation Taxed as per slab if < 3 yrs Gold / Commodity ETFs 3+ years 20% with indexation As per slab So from a tax standpoint, mutual funds and ETFs are almost equal. The difference arises from how you transact — ETFs trigger capital gains every time you sell units on exchange, while mutual funds only do when you redeem. Which Performs Better? Historical data from Indian markets shows: In 2025, as SEBI pushes for passive investing and costs fall, the gap is narrowing. ETFs are gaining traction, with record inflows into Nifty 50 ETF, Gold ETF, and Bharat 22 ETF categories. Which One Should You Choose? Choose Mutual Funds if:✅ You prefer automatic management and goal-based SIPs.✅ You’re not comfortable with a trading account.✅ You value professional fund management over DIY investing. Choose ETFs if:✅ You understand the market and want low-cost exposure.✅ You prefer transparency and real-time pricing.✅ You can manage investments through a Demat account. 💬 Dhwani Shah Patel’s Take: “There’s no one-size-fits-all answer. I recommend using both — core allocation via passive ETFs for low-cost diversification, and satellite exposure via active mutual funds for potential outperformance.” Popular ETFs and Mutual Funds in India (2025 Snapshot) Category Example ETF Example Mutual Fund Equity (Nifty 50) Nippon India ETF Nifty BeES SBI Nifty Index Fund Midcap Motilal Oswal Midcap 100 ETF Axis Midcap Fund Debt Bharat Bond ETF April 2033 HDFC Corporate Bond Fund Gold HDFC Gold ETF SBI Gold Fund International Motilal Oswal NASDAQ 100 ETF PGIM Global Equity Fund Each of these can fit into different parts of your portfolio — ETFs for efficient exposure, funds for strategic alpha. Trends for 2025 and Beyond Key Takeaways Parameter Mutual Funds ETFs Verdict Cost Higher Lower ETF wins Ease of Use Easier (SIP mode) Requires Demat Mutual Fund wins Transparency Monthly disclosure Daily holdings ETF wins Liquidity Moderate High (depends on volume) ETF wins marginally Performance Can outperform Matches index Depends on skill & cost Best For Beginners, SIP investors Active & cost-aware investors Balanced use Example Portfolio Mix If you’re building a ₹10 lakh portfolio: Category Instrument Allocation Type Core Nifty 50 ETF ₹3 lakh ETF Diversification Parag Parikh Flexi Cap Fund ₹2.5 lakh Mutual Fund Stability Bharat Bond ETF 2033 ₹2 lakh ETF Thematic Growth Axis Midcap Fund ₹1.5 lakh Mutual Fund Hedge / Alternative HDFC Gold ETF ₹1 lakh ETF Such a mix gives diversification, cost efficiency, and liquidity. Final Thoughts by Dhwani Shah Patel Both mutual funds and ETFs can build wealth — the key is knowing which one aligns with your behavior. “If you want automation and simplicity, start with mutual fund SIPs. If you love analyzing markets, ETFs give flexibility and lower costs. The smartest portfolios use both — passive ETFs for the core, and selective active funds for alpha.” At Finversify, we believe in empowering investors to make informed, data-driven choices. Whether it’s a swing trade or a long-term wealth plan, clarity always wins. Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is

Trade Setup for 20 October 2025 by dhwani patel

Introduction The Indian equity market extended its winning streak last week, with both Nifty 50 and Bank Nifty posting record-breaking performances. The rally, supported by strong sector rotation and institutional buying, has lifted confidence heading into the new week. In this Trade Setup for 20 October 2025, dhwani patel, SEBI registered research analyst, decodes the exact pivot and Fibonacci levels, latest technical patterns, and 10 structured setups to prepare traders for Monday’s market action. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,710 Special Formation:The Nifty 50 formed a long bullish candle with minor upper and lower shadows, confirming a positive bias despite light volatility. The index maintained its higher high–higher low formation, reflecting sustained buying strength. Above-average volumes and a steady upward slope of key moving averages reinforce structural strength. The RSI surged to 69.34, indicating strong momentum, while the MACD continued its northward move with an expanding histogram — a classic signal of sustained bullish energy. Interpretation: For traders using a Nifty futures trading guide, maintaining a long bias remains logical until price closes below 25,498 on a daily basis. Setup 2 — Bank Nifty: Pivot & Fibonacci Levels Bank Nifty Close: 57,713 Special Formation:The Bank Nifty entered uncharted territory, closing at a new record high. The index formed a bullish candle on the daily timeframe, continuing its higher top–higher bottom structure. All key moving averages point upward, confirming trend strength. The RSI at 74.66 and the MACD’s expanding histogram further validate bullish momentum. Interpretation: For traders applying index futures trading strategies India, any pullback toward 57,200 can serve as a potential accumulation zone with defined stop-losses. Setup 3 — Derivatives & Option Chain Analysis Nifty Call OI: 25,800, 25,900, 26,000Nifty Put OI: 25,600, 25,500, 25,400 Bank Nifty Call OI: 58,000, 58,500Bank Nifty Put OI: 57,500, 57,000 Interpretation:Put writers remain dominant across strikes, especially at 25,600 (Nifty) and 57,500 (Bank Nifty).If both indices sustain above these zones, a round of short-covering could push markets higher into the week’s close. Setup 4 — Sentiment & PCR The Put-Call Ratio (PCR) remains elevated around 1.25, reflecting optimistic positioning.However, traders must monitor for any sharp drop below 1.0 intraday — which may signal short-term profit booking near highs. Overall sentiment remains constructive with FIIs continuing to add index longs. Setup 5 — Volatility & India VIX The India VIX remains low near 10.2, suggesting confidence among market participants.But such suppressed volatility often precedes directional bursts. As dhwani patel notes,“Low volatility feels safe — until it suddenly isn’t. Always trade with stops, even in calm markets.” Traders should be prepared for intraday volatility spikes, especially if global cues turn jittery. Setup 6 — Sectoral Rotation For swing trading strategies India, stick to trending sectors like banking and avoid overexposure in sideways names. Setup 7 — Technical Snapshot Summary Index Candle Type RSI MACD Trend Bias Outlook Nifty 50 Long Bullish 69.34 Bullish Uptrend Positive Bank Nifty Bullish 74.66 Bullish Strong Uptrend Highly Positive Reading:Momentum indicators confirm sustained strength, but overbought signals (RSI > 70 in Bank Nifty) suggest it’s wise to trail profits, not initiate aggressive new longs near resistance. Setup 8 — Global & Institutional Flows The alignment of global stability and domestic inflows creates a conducive environment for continued market resilience. Setup 9 — Intraday Playbook Index Bullish Above Bearish Below Neutral Zone Nifty 50 25,771 25,498 25,550–25,700 Bank Nifty 57,820 57,228 57,400–57,700 Trade Plan: Setup 10 — dhwani patel’s View “Momentum remains healthy and broad-based. Nifty’s trendline breakout and Bank Nifty’s new highs reinforce confidence in bulls. But remember — record highs demand discipline, not complacency.” The Trade Setup for 20 October 2025 continues to favor a bullish bias with trailing stops. Fresh upside is possible if Bank Nifty decisively crosses 57,960, pulling Nifty toward 25,900–26,000. Key Takeaways Final Thoughts The market’s tone remains strong, with both indices comfortably above key moving averages and supported by healthy momentum indicators. Traders can maintain a positive bias while scaling into strength cautiously. As dhwani patel reminds — “Trends last longer than traders expect. The goal isn’t to catch the top — it’s to stay on the right side of the trend with control and clarity.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. This article is for educational and informational purposes only and does not constitute investment advice or recommendations. Trading involves risk. Readers should conduct their own analysis before acting on any insights.

Crude Oil Trading Strategy: A Complete, Up-to-date Playbook (Oct 2025)

Introduction — why a robust crude oil trading strategy matters now Crude oil remains one of the most liquid and news-sensitive markets in the world. Over the past few weeks (Oct 2025) prices have been range-bound near the low-$60s for Brent and high-$50s for WTI, pressured by demand worries and a possible supply surplus into 2026, even as geopolitical events create episodic volatility. Having a clearly defined crude oil trading strategy—one that blends macro awareness with precise technical rules—lets traders profit from short-term swings while protecting capital against sudden shocks. This guide (authored with actionable notes from Dhwani Patel) walks you through up-to-date trade plans, intraday and swing setups, options tactics, position-sizing, and example trades you can adapt for MCX (India) or global crude futures. Current market snapshot (Oct 2025) — what’s moving prices Before trading, understand the near-term drivers: Takeaway: the market has a neutral-to-slightly-bearish bias on the macro calendar but remains tradeable intraday and for multi-day swings when you align with news and structure. Trading approaches — choose the right frame for your temperament We’ll cover practical rules for each and provide examples using current market context. Core rules for any crude oil trading strategy Intraday crude oil trading strategy (practical rules) Time window: focus on U.S. session overlap (approx 6:30 pm – 11:30 pm IST) for the highest intraday liquidity. Indicators: VWAP (day), 20 EMA (5-min), RSI (14), 1-minute/5-minute candles. Setup A — VWAP break + volume confirmation (momentum trade) Setup B — VWAP fade (mean reversion) Why this works now: Range-bound global crude and softened demand signals mean day-to-day directional moves are often mean-reverting unless confirmed by news. Trading around VWAP gives a statistical edge intraday. Recent market diagnostics also show low volatility pockets that make VWAP reversion setups reliable until a large external shock. Swing crude oil trading strategy (2–10 days) — trend-follow blueprint Timeframes: Daily chart for bias, 4-hour for entries, 1-hour for fine-tune. Indicators: 50-EMA (trend), 20-EMA (momentum), MACD (signal), RSI (confirmation), Fibonacci retracement for entries. Long setup (trend-follow): Short setup (trend-follow): the inverse: daily close below 50-EMA, wait for rally into 20-EMA / Fibonacci 38.2–50% and bearish MACD/RSI confirmation. Why this works now: With Brent and WTI trading in a stable range, swing traders can exploit pullbacks into EMAs and ride counter-rotations when a fundamental catalyst (e.g., inventory draw or supply disruption) forces continuation. OPEC commentary suggesting a smaller 2026 deficit means sharp moves will likely be catalyst-driven rather than persistent one-way trends — ideal for disciplined swing trading. Options strategies around oil events (defined risk) Options let you trade crude exposures with defined risk — especially useful around EIA and OPEC windows. 1. Straddle (high-volatility play) 2. Short Iron Condor (volatility sellers) 3. Debit spread (directional but cheaper) Practical note: Options on MCX (or global exchanges) carry different liquidity and skew. Check open interest and bid-ask spreads before placing options trades. In current Oct 2025 conditions, implied vol has receded from summer highs — so straddles cost somewhat less but still expensive ahead of major events. Example trades (live-context ideas you can adapt) All example prices are illustrative; check live prices before trading. Example 1 — Intraday VWAP momentum Example 2 — Swing trend entry after pullback Example 3 — Options straddle ahead of OPEC statement Note: Use these examples as templates. Dhwani Patel recommends verifying global inventory prints and setting alerts for any late-breaking geopolitical headlines before taking significant position sizes. Risk management — the non-negotiable part of any crude oil trading strategy Tools and data sources every crude trader should have Common pitfalls & how to avoid them How Dhwani Patel approaches crude oil trades (practical checklist) Dhwani Patel’s process condenses macro awareness with technical filters into a quick checklist before every trade: This approach helps keep trades consistent and reduces “quick judgement” errors. Building a repeatable trading plan (template) Final checklist before you trade crude today If all checks are green, proceed with your pre-defined position sizing. Conclusion — actionable edge for crude oil traders A robust crude oil trading strategy combines macro awareness (EIA reports, OPEC outlooks, geopolitical risk) with disciplined technical setups (VWAP, EMAs, MACD) and strict risk rules. Current Oct 2025 market conditions show range structure with episodic volatility — ideal for traders who blend intraday VWAP setups with swing entries on pullbacks and who respect event-driven risks. Use options when you want defined risk around major events. Keep the journal, measure outcomes, and iterate. If you’d like, I can convert these rules into a printable trading checklist, build a TradingView watchlist with annotated example charts, or draft a 1-page daily crude market brief you can push to your Telegram followers. — Dhwani Patel Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. This article is for educational and informational purposes only and does not constitute investment advice or recommendations. Trading involves risk. Readers should conduct their own analysis before acting on any insights.

Swing Trading Stocks for This Week (Oct 20–25, 2025): 8 High-Probability Ideas & Trade Plans

Intro — Why swing trading this week? The Indian market has shown strong momentum heading into Diwali, with select large-caps leading a broad rally. That environment creates fast, tradable moves for swing traders — but also requires discipline (defined entries, stops and clear profit objectives). This article gives you a short, practical list of swing trade setups for the week of Oct 19–25, 2025, with technical entry zones, stop-losses, targets, and the catalyst that makes each idea actionable. Recent market momentum (led by top names such as Reliance and Airtel) suggests rotational flows into cyclicals and select midcaps — exactly the environment where swing trades can perform well. 6) Naukri / Info Edge (NAUKRI) — Momentum / IT-services adjacent swing Why: Featured among swing ideas due to relative strength and gap-fill setups on technical scans (also visible in community-sourced setups on TradingView). Platform play benefits if hiring / job trends stay resilient.Entry Zone: Buy on breakout above ₹4,250 or on dip to ₹4,000–4,080.Stop-Loss: ₹3,840.Target 1: ₹4,520 — Target 2: ₹4,800.Trade Notes: Keep exposure moderate; news around business metrics can swing price fast. 7) Suzlon Energy (SUZLON) — Higher risk swing (cyclical + news-driven) Why: Cited by some broker lists as a tactical buy for energy/capex turnarounds; high volatility, but large upside on re-rating or order wins. Use only as a small allocation swing.Entry Zone: Buy on confirmed support hold around ₹95–98 or on breakout above ₹105 with volume.Stop-Loss: ₹88.Target 1: ₹118 — Target 2: ₹135.Trade Notes: This is a higher-risk trade; consider intraday exits if momentum fades. 8) Select PSU / Dividend-yielding names (Coal India, Hindustan Zinc) — Conservative swing plays Why: These names often move with yield/commodity cycles but can offer stable short-term swings when commodity sentiment is positive. Use smaller targets with tight stops.Example Trade (Coal India): Entry ₹270–278, SL ₹258, Target ₹295 / ₹315.Example Trade (Hindustan Zinc): Entry ₹330–340, SL ₹315, Target ₹360 / ₹380.Trade Notes: Best for conservative swing players who want lower beta exposure. Trade management and exit rules Example position-sizing template (quick) Final checklist before you take a swing trade Closing thoughts Swing trading works best when you combine technical clarity (clean entry, confirmed volume) with catalyst awareness (broker interest, corporate events, sector rotation). This week’s market backdrop — festive-season flows and large-cap leadership — creates many short-term opportunities, but also raises the need for strict risk management. If you’d like, I can: Stay disciplined, and happy trading. Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. This article is for educational and informational purposes only and does not constitute investment advice or recommendations. Trading involves risk. Readers should conduct their own analysis before acting on any insights.

Top Dividend Paying Stocks in India (2025): Best Picks for Steady Income

Introduction In a market that often rewards capital gains, many investors overlook a powerful source of returns: dividends. A dividend is a portion of a company’s profit paid to shareholders, and for many investors, it acts like passive income. If you are aiming for consistent income while holding quality stocks, dividend-paying companies become key candidates. This blog dives deep into the top dividend paying stocks in India (2025), how to pick them, and how you can build a balanced dividend-focused portfolio. Whether you are a long-term investor or seeking “coffee-money” from your holdings, this guide is for you. Why Dividend Stocks Matter However, not all dividend stocks are equal. A high dividend yield may look tempting but can be risky if not supported by strong fundamentals. Let’s look at how to evaluate them before jumping into the picks. How to Evaluate Dividend Paying Stocks Before selecting the top dividend stocks, here are critical metrics and qualitative checks: Metric / Check What to Look For Ideal Range / Condition Dividend Yield Dividend per share / current price Typically 3%–8% for large caps; very high yields (10%+) need deeper scrutiny Payout Ratio (%) of earnings paid as dividend Preferably < 60–70% (too high suggests unsustainability) Earnings Growth Ability to grow profits over time 5–15%+ annual growth is favorable Cash Flow Quality Strong operating cash flows Free cash flow should comfortably cover dividends Debt Levels Lower leverage is safer Debt/Equity ratio < 1 (or manageable for sector norms) Consistency & Track Record Stable dividend history Companies with 5–10+ years of dividend stability or growth Sector & Business Model Defensive or regulated sectors often fare better Utilities, power, oil & gas, infrastructure, telecom etc. Top Dividend Paying Stocks in India (2025 Picks) Here’s a curated set of high-dividend stocks in India, combining yield, stability, reputation, and future prospects. Company Approx Dividend Yield* Why It Stands Out Risks to Consider Coal India Ltd. ~6–8%+ Large PSU, cash rich, consistent dividend history ET Money+1 Commodity risk, regulatory & environmental pressures Vedanta Ltd. ~8–10% Diversified mining & metals business, potential for cyclical upside Tickertape+2smallcase+2 Volatility in commodity cycles, capital expenditure needs Hindustan Zinc Ltd. ~5–7% Part of Vedanta, strong balance sheet, lower volatility Metal prices, input costs, regulatory risk Castrol India Ltd. ~5–6% Niche in lubricants, steady demand, moderate payout Commodity risk, margin pressure from raw oils PTC India Ltd. ~6–7% In the power sector, steady cash flows Regulatory risk, currency & interest rates MSTC Ltd. ~7–8% Government-linked, consistent dividend yield record ET Money+1 Limited growth potential, niche business dependencies Gujarat Pipavav Port Ltd. ~5% Infrastructure play, steady usage Port traffic risk, regulatory & environmental hurdles Canara Bank High yield Some public sources show very high yields in banking ET Money Banking sector stress, NPAs, regulatory policy risk *Yields may fluctuate. Always cross-check latest data before investing. Let’s explore a few of these in more detail. Coal India Ltd. Why It’s Attractive: As one of India’s major coal producers with significant government backing, Coal India has shown solid ability to generate profits and distribute them. In recent times, it has offered yields that beat comparable fixed-income rates. Caution: Coal is sensitive to commodity cycles, regulatory changes, carbon pricing, and environmental pressures. Vedanta Ltd. Strengths: Vedanta’s diversified portfolio across mining, metals, oil & gas and its ability to generate cash enables dividend potential. It’s among names listed in high dividend stock lists by multiple platforms. Risks: Its profitability is linked to commodity cycles, and capex demands are high in mining sectors. Also, large investments and debt management must be watched closely. Hindustan Zinc Ltd. Operating under Vedanta, Hindustan Zinc has a relatively stable business, with lower volatility compared to mining for some metals. Its dividend payout has historically been reliable. Risks: Dependent on zinc, lead, silver prices, regulatory oversight, energy costs, and global demand trends. Castrol India Ltd. For those wanting exposure outside pure metals or mining, Castrol India offers exposure to lubricants. It tends to have steadier margins during cycles due to branding and distribution. Risks: Sensitivity to crude oil and base oil prices, competition from global players, margin pressure from raw cost swings. How to Build a Dividend Portfolio Risks & Caveats in Dividend Investing Case Study: HCL Tech — Dividend Consistency HCL Technologies recently announced its 91st consecutive quarterly dividend at ₹12 per share, emphasizing its focus on returning capital to shareholders. The Economic Times It’s not a high-yield stock, but the consistency showcases the kind of stable dividend philosophy ideal for portfolio builders. Actionable Steps for Investors Conclusion “Top dividend paying stocks in India” is not just a phrase — it’s a strategy for those seeking income plus capital gains. While the likes of Coal India, Vedanta, Hindustan Zinc, and Castrol India often feature in dividend lists, what distinguishes a great dividend stock is sustainability, growth, and strong fundamentals.

Trade Setup for 17 October 2025 by dhwani patel

Introduction Indian markets enter October 17, 2025, on a strong footing after back-to-back bullish sessions. A broad-based rally across sectors helped both Nifty 50 and Bank Nifty reclaim key resistance zones, turning them into short-term supports. In this Trade Setup for 17 October, dhwani patel, SEBI registered research analyst, breaks down the exact pivot and Fibonacci levels, recent technical formations, and 10 actionable setups for traders and investors preparing for Friday’s trade. ⚙️ Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,585 Special Formation:The Nifty 50 formed a long bullish candle on the daily charts after a gap-up opening, moving decisively above its downward-sloping resistance trendline, which now acts as a new support zone. All key moving averages continue to trend upward, confirming trend alignment. The RSI has risen to 66.82, while the MACD sustains a bullish crossover with an expanding histogram — clear evidence of momentum strength. Interpretation: From a Nifty futures trading guide perspective, the structure remains bullish — traders can maintain a buy-on-dips approach while guarding profits near upper bands. ⚙️ Setup 2 — Bank Nifty: Pivot & Fibonacci Levels Bank Nifty Close: 57,423 Special Formation:The Bank Nifty formed a bullish candle with minor upper and lower shadows — signaling firm control by buyers despite mild volatility. The index is now just shy of its record high of 57,628, reflecting sustained upward momentum. It continues to form a higher high–higher low pattern, with the RSI elevated at 72.64 and MACD confirming a bullish structure.Key moving averages remain upward sloping, highlighting a strong technical setup. Interpretation: Banking stocks remain the primary driver of market strength — ideal for traders implementing index futures trading strategies India. ⚙️ Setup 3 — Option Chain Insights Nifty Call OI: 25,700, 25,800, 26,000Nifty Put OI: 25,400, 25,300, 25,200 Bank Nifty Call OI: 57,500, 58,000Bank Nifty Put OI: 57,000, 56,500 Interpretation:The concentration of puts around 25,300–25,400 and 57,000 highlights strong short-term support.Call writers remain cautious beyond 25,700 on Nifty and 57,500 on Bank Nifty.If price sustains above those strike levels, short-covering could add momentum into the weekend. ⚙️ Setup 4 — Market Sentiment & PCR The Put-Call Ratio (PCR) for Nifty stands near 1.15, reflecting moderate bullishness.Sentiment is constructive but not overstretched.If PCR jumps beyond 1.3, traders should watch for possible profit-booking near resistance zones. For now, market structure favors the bulls with steady volumes and broad participation. ⚙️ Setup 5 — Volatility View: India VIX India VIX remains subdued near 10.5 — a zone associated with calm trading conditions.However, with Nifty approaching fresh highs, complacency risk increases.A sudden VIX spike could bring intraday whipsaws — traders should tighten stop-losses and size positions accordingly. ⚙️ Setup 6 — Sectoral Trends For swing trading strategies India, rotating between strong sectors and staying aligned with trend direction offers higher reward potential. ⚙️ Setup 7 — Technical Snapshot Summary Index Candle Type Momentum RSI MACD Outlook Nifty 50 Long Bullish Strong 66.82 Bullish Crossover Positive Bank Nifty Bullish Very Strong 72.64 Bullish Crossover Highly Positive Reading:Both indices exhibit trend confirmation across price, momentum, and volume data — a trifecta of bullish strength. The only caution is RSI nearing overbought territory; traders should trail profits instead of initiating fresh large positions mid-zone. ⚙️ Setup 8 — Global Cues & FII-DII Data Global equity sentiment remains mildly positive. Together, this backdrop supports continued upside unless global volatility spikes unexpectedly. ⚙️ Setup 9 — Intraday Trade Plan Index Bullish Above Bearish Below Neutral Zone Nifty 50 25,624 25,376 25,400–25,600 Bank Nifty 57,517 56,986 57,000–57,400 Plan: Stay light on size during first-hour volatility; increase exposure only once direction confirms. ⚙️ Setup 10 — dhwani patel’s View “Momentum has matured but not exhausted. The structure favors continuation with higher supports now acting as launchpads. Keep positions aligned with the trend, not against it.” The Trade Setup for 17 October 2025 signals a continuation phase — bulls retain control, but traders should protect profits with discipline.Intraday volatility may increase near resistance; prepare for possible consolidation before the next leg up. ⚠️ Key Takeaways Final Thoughts The market momentum remains healthy, with both indices showing strong alignment between trend, volume, and momentum indicators.Traders can maintain a bullish bias but should stay alert to intraday fluctuations as indices approach higher resistance zones. As dhwani patel puts it — “Markets reward patience in trends and discipline in volatility. Know your levels, manage your risk, and let the trend work for you.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. This article is for educational and informational purposes only and does not constitute investment advice or recommendations. Trading involves risk. Readers should conduct their own analysis before acting on any insights.

Trade Setup for 16 October 2025 by dhwani patel

Introduction The market enters October 16, 2025, with an optimistic tone as both Nifty 50 and Bank Nifty continue to trade above their key moving averages. The bullish momentum seen earlier this week seems to have extended further, supported by positive technical formations and improving market breadth. In this Trade Setup for 16 October, dhwani patel, SEBI registered research analyst, breaks down the exact pivot and Fibonacci levels, technical formations, and 10 structured setups to help traders navigate today’s session with clarity and control. ⚙️ Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,324 Technical Outlook:The Nifty 50 formed a long bullish candle with small upper and lower shadows — a strong indicator of buyer dominance. The index now trades well above all key moving averages, with both short- and medium-term averages sloping upward. The RSI at 60.49 confirms strength, while the MACD maintains a bullish crossover with an expanding histogram. This combination supports a positive short-term outlook. Interpretation: For traders following a Nifty futures trading guide, the bias remains bullish with “buy-on-dips” setups favored until 25,155 holds. ⚙️ Setup 2 — Bank Nifty: Pivot & Fibonacci Levels Bank Nifty Close: 56,800 Technical Outlook:Bank Nifty rebounded strongly after a day of consolidation, forming a bullish candle that completed a 78.6% Fibonacci retracement from July’s record high to the September low. The index now sits comfortably above all major moving averages, signaling sustained strength. Both RSI and MACD show a positive bias, confirming momentum alignment with price structure. Interpretation: This pattern reflects the characteristics of a continuation phase — ideal for index futures trading strategies India built around trend-following logic. ⚙️ Setup 3 — Derivatives & Option Chain Data Nifty OI: Bank Nifty OI: Interpretation:The options setup suggests a mild bullish bias, with put writers active near 25,200 on Nifty and 56,500 on Bank Nifty. Unless these supports break, the market is likely to maintain higher lows. ⚙️ Setup 4 — Market Sentiment & PCR The Put-Call Ratio (PCR) for Nifty hovers near 1.05 — balanced but tilted bullish.An uptick beyond 1.2 may reflect overconfidence, while a dip below 0.9 could indicate hedging pressure. Sentiment currently leans positive, supported by steady FII participation and range-bound VIX levels. ⚙️ Setup 5 — Volatility Index (India VIX) India VIX remains subdued around 10.8, indicating stable risk appetite among traders.However, with indices nearing upper resistance, sudden spikes in volatility can’t be ruled out. “Low VIX gives confidence, but it’s also where traders often get complacent,”says dhwani patel.Use volatility compression as an opportunity for breakout setups, not comfort. ⚙️ Setup 6 — Sectoral Focus Strategy Tip: Rotate capital toward trending sectors — a core aspect of swing trading strategies India. ⚙️ Setup 7 — Technical Formations Recap Index Candle Type Trend Signal Indicators Outlook Nifty 50 Long bullish candle Sustained uptrend RSI > 60, MACD bullish Positive Bank Nifty Bullish candle, post-retracement Trend continuation RSI, MACD rising Positive Both indices reflect healthy internal structure, confirming that dips remain buyable until lower supports are violated. ⚙️ Setup 8 — Global & Macro Influences US and European markets closed mixed, while Asian peers opened stable. Crude prices stayed range-bound, and bond yields softened — both favorable for emerging markets. These cues should keep Indian indices supported, provided no external shock emerges mid-session. ⚙️ Setup 9 — Intraday Playbook Index Bullish Above Bearish Below Neutral Zone Nifty 50 25,361 25,155 25,200–25,300 Bank Nifty 57,004 56,472 56,600–56,900 Trading Plan: Risk discipline remains your edge; overconfidence is your enemy. ⚙️ Setup 10 — dhwani patel’s View “Momentum remains aligned with trend. The chart structure is strong, and data supports continuation. But traders should protect profits and trail stops — markets reward preparation, not prediction.” With both Nifty and Bank Nifty sustaining above key averages, the setup favors a steady upward bias with selective opportunities in large-cap banks and midcaps. ⚠️ Key Takeaways Final Thoughts The Trade Setup for 16 October 2025 signals confidence with caution — the market trend remains intact, but traders must stay agile. As dhwani patel reminds every morning — “Your discipline decides your returns. The market only gives you what you deserve.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. This content is for educational purposes only and should not be construed as investment advice or a buy/sell recommendation. Markets are volatile; always conduct independent analysis.