Market Overview The Indian market took a breather on Tuesday, with benchmark indices closing mildly lower after a strong rally in the previous sessions. Despite minor profit-booking, the broader structure remains positive, although early signs of caution have emerged on the daily charts. In this detailed breakdown, SEBI-registered Research Analyst Dhwani Patel highlights the key levels, technical indicators, derivatives data, and market sentiment to help traders plan the day effectively. 1) Nifty 50 – Key Levels Nifty Close: 25,910 Resistance (Pivot Points): Support (Pivot Points): Technical View The Nifty formed a bearish candle resembling a Bearish Engulfing–type pattern, typically a sign of potential reversal — but confirmation is required in the next trading session. Despite this, the index still trades above all key moving averages. Indicators: Market tone: Watch for price action near 25,844 – 25,880. Holding these levels keeps the uptrend intact. 2) Bank Nifty – Key Levels Bank Nifty Close: 58,899 Resistance (Pivot Points): Support (Pivot Points): Fibonacci Levels: Technical View Bank Nifty formed a bearish candle with upper and lower shadows, reflecting volatility and hesitation after touching a new high of 59,104. However, the index continues to maintain its higher-high, higher-low structure. Indicators: 3) Nifty Call Options Data Max Call Writing: Max Call Unwinding: Interpretation:Call writers are aggressively defending 26,000 — a key hurdle for the index. 4) Nifty Put Options Data Max Put Writing: Max Put Unwinding: Interpretation:Put writers remain active, creating a strong base around 25,800–26,000. 5) Bank Nifty Call Options Data Max Call Writing: Max Call Unwinding: Interpretation:Strong resistance building near 59,000. 6) Bank Nifty Put Options Data Max Put Writing: Put Unwinding: Interpretation:Support building near 58,400–58,500 remains strong. 7) Put-Call Ratio (PCR) Interpretation:PCR edging lower, indicating a slight rise in caution — but still within a neutral-to-positive zone. 8) India VIX Volatility has picked up after a brief dip.Major discomfort only if VIX sustains above 13. Key Takeaways by Dhwani Patel Disclosure & Disclaimer Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst.This report is prepared for educational purposes only and should not be treated as investment advice. Trading in markets involves risk. Please consult your financial advisor before taking positions.

Trade Setup for 18 November 2025 by Dhwani Patel

Market Overview Indian equities continued their upward momentum, with both benchmark indices extending gains into Monday’s session. The market opened higher, sustained strength throughout the day, and closed on a firm note, driven by improving technical indicators and strong sectoral participation. With the Nifty crossing the 26,000 milestone and the Bank Nifty moving into uncharted territory, sentiment remains firmly in favour of the bulls. In this report, Dhwani Patel, SEBI-registered Research Analyst, breaks down the key levels, options data, and major technical cues for today’s trade. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 26,013 Resistance (Pivot Points): Support (Pivot Points): Market View The Nifty 50 formed a bullish candle with a higher-high, higher-low structure, clearly signalling an extension of the uptrend. The index is now holding well above every key moving average, while short-term and medium-term averages are turning upward in alignment with the ongoing bullish structure. Key Indicators: Bias: Strongly bullish with improving momentum. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,963 Resistance (Pivot Points): Support (Pivot Points): Fibonacci Levels: Market View Bank Nifty tested the 59,000 level for the first time and surged 0.76%, breaking into fresh all-time-high territory. The index closed above the upper Bollinger Band, reflecting strong buying pressure. Momentum indicators continue to strengthen, signalling a firm bullish structure. Key Indicators: Bias: Strong bullish continuation. Setup 3 — Nifty Call Options Data Max Call Writing: Max Call Unwinding: Interpretation: Writers are aggressively building positions above 26,000, indicating a potential ceiling for the short term, unless a breakout is sustained. Setup 4 — Nifty Put Options Data Max Put Writing: Max Put Unwinding: Interpretation: Strong base now forming between 25,800–25,900, providing a cushion for dips. Setup 5 — Bank Nifty Call Options Data Max Call OI: Max Call Writing: Max Call Unwinding: Interpretation: Profit-taking seen at lower OTM strikes while writers reposition at higher levels. Setup 6 — Bank Nifty Put Options Data Max Put OI: Max Put Writing: Put Unwinding: Minimal unwinding across major strikes — strong put writing indicates bullish sentiment. Setup 7 — Put-Call Ratio (PCR) Interpretation: A rising PCR above 1 shows stronger Put writing than Call writing — signalling continued bullish bias. Setup 8 — India VIX Interpretation: Lower volatility levels give bulls a comfortable environment to extend the rally. Key Takeaways by Dhwani Patel Disclosure & Disclaimer Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst.This report is for educational and informational purposes only and should not be considered investment advice. Trading and investing involve risk. Please consult your financial advisor before taking any decision.

Top Swing Trading Stocks for This Week (Nov 17–21, 2025) | Short-Term Trading Ideas by Dhwani Patel

Market Outlook As markets continue their November momentum, traders are witnessing a steady improvement in broader sentiment. The Nifty 50 has been holding above key support levels, while Bank Nifty continues to show leadership with strong volume-backed buying. Sector rotation remains active—IT, Energy, Banking, Pharma, and select Midcaps are showing strength. Volatility also remains under control, creating a favourable environment for short-term trading setups. Based on price action, volume structure, RSI strength, MACD confirmation and short-term trend behaviour, here are the Top Swing Trading Stocks curated for this week by Dhwani Patel. Top 5 Swing Trading Stocks for This Week (Nov 17–21, 2025) (All levels are approximate ranges based on technical behaviour) 1. Adani Ports & SEZ (CMP ₹1,512) Setup: Strong trending structure with steady higher-high formation. Volume expansion confirms institutional interest. 2. Asian Paints (CMP ₹2,906) Setup: Defensive strength visible; counter forming a stable recovery from support. 3. Muthoot Finance (CMP ₹3,725) Setup: One of the strongest breakouts among financial stocks, backed by excellent volume and momentum. 4. Canara Bank (CMP ₹146) Setup: PSU banks continue to attract momentum traders; this stock shows a stable trending pattern. 5. Adani Energy Solutions (CMP ₹1,023) Setup: Breakout attempt with improving short-term structure. Bonus Watchlist Stocks (For traders looking for additional opportunities) Vodafone Idea (CMP ₹10.94) Range-bound but offering good trading opportunities above ₹11.20.Watch for: Breakout strength above immediate resistance. GMR Airports (CMP ₹95.67) Stable midcap with strong chart structure.Watch for: Follow-through buying above ₹97–98. Star Health Insurance (CMP ₹522.45) Showing sharp recovery with improving financial visibility.Watch for: Sustained move above ₹530. Pine Labs (CMP ₹250.89) Momentum stock turning from oversold conditions.Watch for: Bullish crossover with volume. Strategy for the Week Key Takeaways (Tabular Summary) Stock Bias Entry Zone Target Range Stop-Loss Adani Ports Bullish Continuation 1,500–1,525 1,575–1,620 1,455 Asian Paints Bullish Pullback 2,880–2,920 2,980–3,040 2,825 Muthoot Finance Bullish Breakout 3,680–3,740 3,850–3,950 3,590 Canara Bank Bullish Trend 144–147 153–157 137 Adani Energy Bullish Reversal 1,015–1,035 1,070–1,110 975 Dhwani Patel’s Trading Insight “Successful swing trading is not about catching tops or bottoms—it’s about aligning with price strength, respecting risk, and exiting with discipline. A clear plan and structured risk management are the foundation of profitable trading.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst. All information provided is for educational and informational purposes only and should not be considered investment advice. Trading in equities involves risk. Consult your financial advisor before making investment decisions.

Trade Setup for 17 November 2025 by Dhwani Patel

Market Overview Indian equity markets extended their winning streak for the second straight session on Friday, led by strong buying across banking, financials, and IT stocks. The Nifty 50 advanced 31 points to close at 25,910, while the Bank Nifty gained 134 points to end at 58,518, marking a new record closing high. The broader sentiment remained positive as investors continued to accumulate quality stocks on dips amid robust quarterly earnings and firm global cues. The Nifty Midcap 100 and Smallcap 100 indices gained 0.46% and 0.39%, respectively, showing healthy participation across sectors. Experts believe the market tone remains bullish, supported by easing volatility and steady institutional flows. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,910 Market View: The Nifty 50 formed a long bullish candle with above-average volume, confirming renewed buying momentum after a brief pause. The index continued to trade above all major moving averages and within the upper Bollinger Band, reflecting strong upward momentum. Momentum indicators also support the bullish view — the RSI stood at 62.24 with a bullish crossover, while the Stochastic RSI remained in a positive zone. The MACD is inching closer to the signal line, and the histogram is nearing the zero mark, both hinting at strengthening trend continuation. Outlook: The index looks poised to test 26,000–26,100 levels, with support seen around 25,740–25,750. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,518 Market View: The Bank Nifty continued its strong upward journey, forming a long bullish candle on the daily chart and sustaining above the falling trendline, which now acts as crucial support. The index also reached the upper end of the Bollinger Band, signaling an extended uptrend. Momentum indicators remain robust — the RSI (67.08) maintains a positive crossover, and the Stochastic RSI sustains its bullish signal. The MACD histogram continues to show fading weakness, confirming strength in the trend. Outlook: Bank Nifty remains in a clear uptrend with support at 58,100–58,200 and potential upside toward 58,900–59,000. Setup 3 — Nifty Call Options Data Interpretation:Call writers remain active around the 26,000–26,200 zone, making it a key resistance band in the short term. Setup 4 — Nifty Put Options Data Interpretation:Aggressive Put writing near 25,700–25,800 levels reflects strong base formation and bullish undertone. Setup 5 — Bank Nifty Call Options Data Interpretation:Call writers continue to hold ground at 58,500–59,000, signaling consolidation near record highs before a potential breakout. Setup 6 — Bank Nifty Put Options Data Interpretation:The strong Put writing at 58,500 reflects continued confidence among bulls that the index will maintain its upward trajectory. Setup 7 — Put-Call Ratio (PCR) The Nifty PCR slipped to 0.92 on November 14, compared to 1.10 in the prior session, indicating mild profit booking and some hedging at higher levels. Interpretation:While the ratio remains above the neutral zone, the dip in PCR suggests a cautious phase of consolidation before the next directional move. Setup 8 — India VIX The India VIX, which gauges near-term market volatility, fell 1.85% to 11.94, staying comfortably below its 10- and 100-day EMAs.Low volatility levels provide comfort for the bulls, indicating a stable environment for risk-taking. Interpretation:A sustained VIX below 12 reinforces bullish sentiment and reduces the likelihood of sharp short-term corrections. Setup 9 — Strategy for the Day by Dhwani Patel Key Takeaways Index Bias Bullish Above Bearish Below Range Nifty 50 Bullish 25,800 25,700 25,700–26,100 Bank Nifty Positive 58,200 57,900 57,900–59,000 Dhwani Patel’s Market Insight “The market’s structure continues to strengthen as both indices sustain above key moving averages. Traders should maintain a bullish bias with strict trailing stops and focus on quality momentum setups.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst. This content is intended solely for educational and informational purposes and should not be construed as investment advice. Investing in equities involves risks; please consult a certified financial advisor before taking any investment decisions.

Trade Setup for 14 November 2025 by Dhwani Patel

Market Overview Indian equity markets displayed consolidation on Thursday after a strong three-day rally. The Nifty 50 ended almost flat amid volatility, reflecting cautious sentiment ahead of key macroeconomic data. The index moved in a narrow range throughout the session, closing marginally higher at 25,879, while the Bank Nifty gained modestly to finish at 58,382 after touching an intraday record high of 58,616. Despite limited movement, buying interest remained intact in banking and IT counters, while mild profit booking was seen in select FMCG and consumer stocks.Broader indices ended on a mixed note, with the Nifty Midcap 100 up 0.28% and the Smallcap 100 lower by 0.12%, suggesting a balanced market tone. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,879 Market View: The Nifty 50 formed a small bearish candle with both upper and lower shadows — a high-wave or Doji-like formation, signaling indecision between bulls and bears. Short-term moving averages trended upward, and the RSI climbed to 61.36, showing a positive crossover. The Stochastic RSI sustained a bullish bias, while weakness in the MACD histogram faded further even though the MACD remained below the signal line. Outlook: As long as the index stays above 25,770–25,800, the structure remains healthy. A breakout above 26,000 could lead to a rally toward 26,150, while immediate support lies near 25,700. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,382 Market View: The Bank Nifty sustained well above its earlier resistance trendline — which has now turned into strong support. The index reached a fresh intraday high of 58,616, forming a bullish candle with an upper shadow, showing profit-booking at higher levels. Momentum remains strong as the RSI (65.61) crossed above the reference line, indicating renewed strength. The Stochastic RSI maintained its bullish crossover, while the MACD stayed above the zero line despite its bearish signal — with the histogram weakening less sharply. Outlook: The banking index shows strong support around 58,100–58,200, with the potential to test 58,800–59,000 in the near term. Setup 3 — Nifty Call Options Data Interpretation:Call writers continue to defend the 26,000–26,200 zone, making it a key resistance band for the near term. Setup 4 — Nifty Put Options Data Interpretation:Put writers are reinforcing positions around 25,500, which remains a critical support level for the index. Setup 5 — Bank Nifty Call Options Data Interpretation:The 58,500 strike continues to act as a major ceiling, with significant short build-up observed at higher strikes. Setup 6 — Bank Nifty Put Options Data Interpretation:Strong Put writing between 58,400–58,700 suggests robust support for the index and reduced downside risk. Setup 7 — Put-Call Ratio (PCR) The Nifty PCR dropped to 1.10 on November 13 from 1.23 in the previous session.A declining PCR signals a rise in call writing and mild profit-booking at higher levels, reflecting short-term caution amid the broader bullish trend. Interpretation:While momentum remains positive, traders are likely hedging positions ahead of weekend volatility. Setup 8 — India VIX The India VIX, a measure of near-term market volatility, edged slightly higher by 0.43% to 12.16 but remained below the 13-mark and under its 10-day EMA.This reflects continued comfort for the bulls and minimal risk of a sudden sharp correction. Interpretation:As long as the VIX stays below 13, markets are likely to maintain a stable-to-positive tone. Setup 9 — Strategy for the Day by Dhwani Patel Key Takeaways Index Bias Bullish Above Bearish Below Range Nifty 50 Positive 25,900 25,700 25,700–26,050 Bank Nifty Bullish 58,100 57,900 57,900–58,900 Dhwani Patel’s Market Insight “The overall trend continues to favor the bulls, though mild profit booking at higher levels can’t be ruled out. Traders should watch for sustained moves above key resistance levels while keeping trailing stop-losses in place to protect gains.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst. This content is meant solely for educational and informational purposes. It should not be considered investment advice. Trading and investing in securities involve market risk — please consult a certified financial advisor before making any financial decisions.

Trade Setup for 13 November 2025 by Dhwani Patel

Market Overview Indian markets extended their positive momentum on Wednesday, with the Nifty 50 registering its third consecutive day of gains as investor sentiment strengthened across sectors. The index opened with a healthy gap-up and sustained higher levels throughout the session, driven by robust buying interest in banking, IT, and metal counters. The Nifty 50 closed 83 points higher at 25,876, while the Bank Nifty added 133 points to end at 58,275. Both indices remained resilient, supported by favorable global cues and consistent institutional inflows. Broader market indices also stayed firm, with the Nifty Midcap 100 rising 0.58% and the Nifty Smallcap 100 up 0.42%, indicating strong participation across segments. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,876 Market View: The Nifty 50 formed a bullish candle with upper and lower shadows after a gap-up opening, signaling a continuation of the prevailing uptrend. Trading volumes remained above average, confirming strong participation. The index stayed above all key moving averages and the midline of the Bollinger Band, highlighting sustained strength. Momentum indicators also improved — the RSI climbed to 61.27, nearing a bullish crossover zone, while the Stochastic RSI sustained its positive bias. Although the MACD remains below the signal line, the histogram shows diminishing negative momentum — a sign of steady improvement. Outlook: The setup favors continued bullish momentum. Sustaining above 25,900 could open the door toward 26,000–26,100, while support lies at 25,700. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,275 Market View: The Bank Nifty ended marginally higher after showing early signs of consolidation. A Bearish Belt Hold-like pattern emerged on the daily chart following a sustained rally since last Friday. Despite the mild pause, the index closed 0.23% higher, comfortably maintaining its position above the falling resistance trendline and all major moving averages. The RSI (64.44) continues to edge higher, moving close to a bullish crossover zone, while the Stochastic RSI sustains its positive crossover. The MACD remains below the reference line, but the histogram reflects fading weakness, hinting at steady momentum buildup. Outlook: The banking index is expected to remain stable above 57,900, with potential upside targets around 58,600–58,800. Setup 3 — Nifty Call Options Data The weekly derivatives data reveals strong positioning around higher strike zones: Interpretation:The 26,000 strike remains a strong resistance area for the near term, with fresh call writing indicating limited upside until a breakout occurs above this level. Setup 4 — Nifty Put Options Data Interpretation:Put writers are aggressively building positions near 25,800–25,900, suggesting strong support and confidence in the ongoing uptrend. Setup 5 — Bank Nifty Call Options Data Interpretation:Call writers remain active near 58,400–58,600, signaling potential resistance, but the overall setup still favors gradual strengthening above 58,000. Setup 6 — Bank Nifty Put Options Data Interpretation:Aggressive put writing around 58,000–58,500 suggests strong positional support, which could cushion any short-term pullbacks. Setup 7 — Put-Call Ratio (PCR) The Nifty Put-Call Ratio (PCR) increased to 1.23 on November 12, up from 1.08 in the previous session.A higher PCR, typically above 1, implies traders are selling more Put options than Calls — reflecting a strengthening bullish sentiment in the market. Interpretation:Rising PCR levels confirm improved confidence among buyers, hinting at a continuation of the upward momentum. Setup 8 — India VIX The India VIX, India’s volatility index, declined by 3.04% to 12.11, indicating reduced market fear and higher comfort for bulls.A further drop below 11 levels could enhance the probability of a sustained uptrend. Interpretation:Falling volatility levels combined with steady options data indicate a favorable risk-reward setup for long positions. Setup 9 — Strategy for the Day by Dhwani Patel Key Takeaways Index Bias Bullish Above Bearish Below Range Nifty 50 Bullish 25,900 25,700 25,700–26,000 Bank Nifty Positive 58,200 57,900 57,900–58,800 Dhwani Patel’s Market Insight “The index structure remains firmly positive as buyers continue to defend crucial support zones. Traders should stay aligned with the trend and trail stop-losses to protect profits while eyeing breakout levels for confirmation.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst. This content is prepared for educational and informational purposes only and should not be interpreted as investment advice. Trading and investing in securities carry market risks; please consult a certified financial advisor before taking investment decisions.

Trade Setup for 12 November 2025 by Dhwani Patel

Market Overview Indian equity markets extended their winning streak on Tuesday, closing higher for the second consecutive session amid improving investor sentiment and stability in global cues. The Nifty 50 advanced 121 points to settle at 25,695, while the Bank Nifty climbed 261 points to close at 58,138. The day witnessed healthy buying across Banking, IT, and Pharma counters, while FMCG and Auto saw selective profit booking. Broader markets outperformed benchmarks — the Nifty Midcap 100 gained 0.72% and the Smallcap 100 rose 0.61%, highlighting renewed strength in the broader universe. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,695 Market View: The Nifty 50 formed a bullish candle with a long upper shadow on the daily charts, showing sustained buying interest at lower zones. The index now trades above all major moving averages, signaling an improving structure. The RSI (56.07) indicates strengthening momentum, while the Stochastic RSI maintained a positive crossover, confirming a shift in bias toward bulls. The MACD continues to stay below its reference line, but fading negative momentum suggests early signs of recovery. Outlook: Sustaining above 25,700 could push the index toward 25,850–26,000. On the downside, 25,450 remains key short-term support. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,138 Market View: The Bank Nifty extended gains for the third consecutive session, forming a bullish candle with a long lower shadow — a sign of buying from lower levels. Momentum indicators reflect growing strength: RSI improved to 62.95, while Stochastic RSI maintained a bullish crossover. The MACD still trades below the signal line, but fading weakness in the histogram confirms improving market tone. Outlook: Bank Nifty remains bullish with a potential upside towards 58,700–59,000, while support holds near 57,400. Setup 3 — Nifty Options Data Call Option Data (CE): Put Option Data (PE): Interpretation:Nifty’s option data suggests a tight trading band between 25,500–26,000, indicating consolidation before a possible breakout. Setup 4 — Bank Nifty Options Data Call Option Data (CE): Put Option Data (PE): Interpretation:Bank Nifty’s option activity reflects bullish bias with 58,000 acting as a firm base and potential resistance near 58,600. Setup 5 — Sectoral Overview Sector Sentiment Commentary Banking & Financials Bullish Strong buying seen; momentum improving across private banks. IT Positive FII buying supports the uptrend; select midcaps outperform. Pharma Positive Defensive strength continues amid global uncertainty. FMCG Neutral Range-bound after mild profit booking. Metals Bullish Global commodity strength supports renewed buying interest. Setup 6 — India VIX The India VIX, which gauges near-term market volatility, fell slightly to 11.82, maintaining calm conditions.As long as the volatility index stays below the 13–14 zone, markets are likely to remain stable with a bullish undertone. Setup 7 — Strategy for the Day by Dhwani Patel Key Takeaways Index Bias Bullish Above Bearish Below Range Nifty 50 Positive 25,700 25,450 25,450–25,900 Bank Nifty Bullish 58,000 57,400 57,400–58,800 Dhwani Patel’s Market Insight “Momentum is gradually shifting back to the bulls as markets reclaim key averages. Traders should focus on breakout confirmation over anticipation and ride the trend with disciplined stop-loss placement.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst. This report is intended for educational and informational purposes only and should not be construed as investment advice. Trading and investing in securities involve market risks; always consult a certified financial advisor before taking any investment decisions.

Trade Setup for 11 November 2025 by Dhwani Patel

Market Overview After staging a sustainable rebound from the crucial trendline support near 25,300 levels on Friday, the Nifty 50 extended its upmove on Monday amid volatility and ended higher by 82 points at 25,574. The index snapped its three-session losing streak. The market opened on a positive note and advanced further in early trade but encountered mild resistance near 25,650 levels before slipping into a late-session decline.Overall, the index traded in a narrow band between 25,500 and 25,650 throughout the day. Among top performers, Infosys, Bajaj Finance, and HCL Tech led the gains, while Trent, Max Healthcare, and Tata Consumer faced selling pressure.The broader market outperformed, with the Nifty Midcap 100 gaining 0.47% and the Nifty Smallcap 100 rising 0.35%. Sectoral performance was mixed, as IT, Pharma, and Metal indices closed in the green, while FMCG, Realty, and Media witnessed declines.Renewed foreign inflows also supported the market sentiment, with FIIs buying shares worth ₹4,581 crore and DIIs adding ₹6,675 crore in equities. Market Outlook The market continues to show resilience after defending the crucial 25,300 support zone, indicating strength in the broader trend. However, the index faces stiff resistance near 25,650–25,700, where selling pressure has been evident. A breakout above 25,700 could take the Nifty toward 26,000, while dips around 25,400–25,300 are expected to attract buying interest. The broader market structure remains constructive, and a breakout above 25,650 could trigger an upward move toward 25,800.A move above 25,600 will be crucial to confirm a directional uptrend; until then, the index may continue its sideways consolidation. The Nifty 50 appears to be in a consolidation phase, with the 50-day EMA near 25,338 acting as a strong support and resistance placed at 25,680–25,803. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,574 Market View: The Nifty 50 formed a bullish candle with a long lower shadow on the daily charts, indicating buying interest at lower levels despite mild pressure near the upper zone.The RSI has recovered to 52, while the MACD is flattening out near the neutral line — hinting at stabilising momentum. Outlook: Sustaining above 25,700 could push the index toward 25,900–26,000, while holding 25,400 will be crucial for maintaining bullish momentum. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 57,900 Market View: The Bank Nifty rebounded after two weak sessions, forming a bullish candle on the daily chart. The index is trading above its 20-day EMA and is likely to stay range-bound before a clear breakout. The RSI has moved up to 62.7, showing positive bias, though a move above 58,200 is essential for sustained strength. Outlook: A decisive close above 58,200 could lead to a rally toward 58,700–59,000, while support lies near 57,400–57,300. Setup 3 — Sectoral Overview Sector Sentiment Commentary IT Positive Backed by strong buying momentum and renewed global cues. Pharma Positive Outperformance continues amid defensive rotation. FMCG Neutral Mild profit booking seen post recent rallies. Metals Mildly Positive Benefiting from rebound in global commodity prices. Banking & Financials Neutral to Positive Range-bound trade, likely breakout above 58,200. Setup 4 — India VIX The India VIX, which measures market volatility, slipped 0.74% to 11.78, reflecting lower volatility and stable sentiment.A sustained reading below the 13–14 zone supports a bullish environment for the near term. Setup 5 — Strategy for the Day by Dhwani Patel Key Takeaways Index Bias Bullish Above Bearish Below Range Nifty 50 Positive 25,700 25,400 25,400–25,900 Bank Nifty Neutral to Positive 58,200 57,400 57,400–58,700 Dhwani Patel’s Market Insight “The market is slowly stabilising after recent volatility. A sustained move above resistance levels could spark fresh momentum in key sectors. Traders should stay selective, focus on volume confirmation, and avoid aggressive shorts unless Nifty closes below 25,400.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst. This report is intended solely for educational and informational purposes and should not be considered as investment advice. Trading and investing in securities involve financial risk; investors should consult their financial advisors before taking positions.

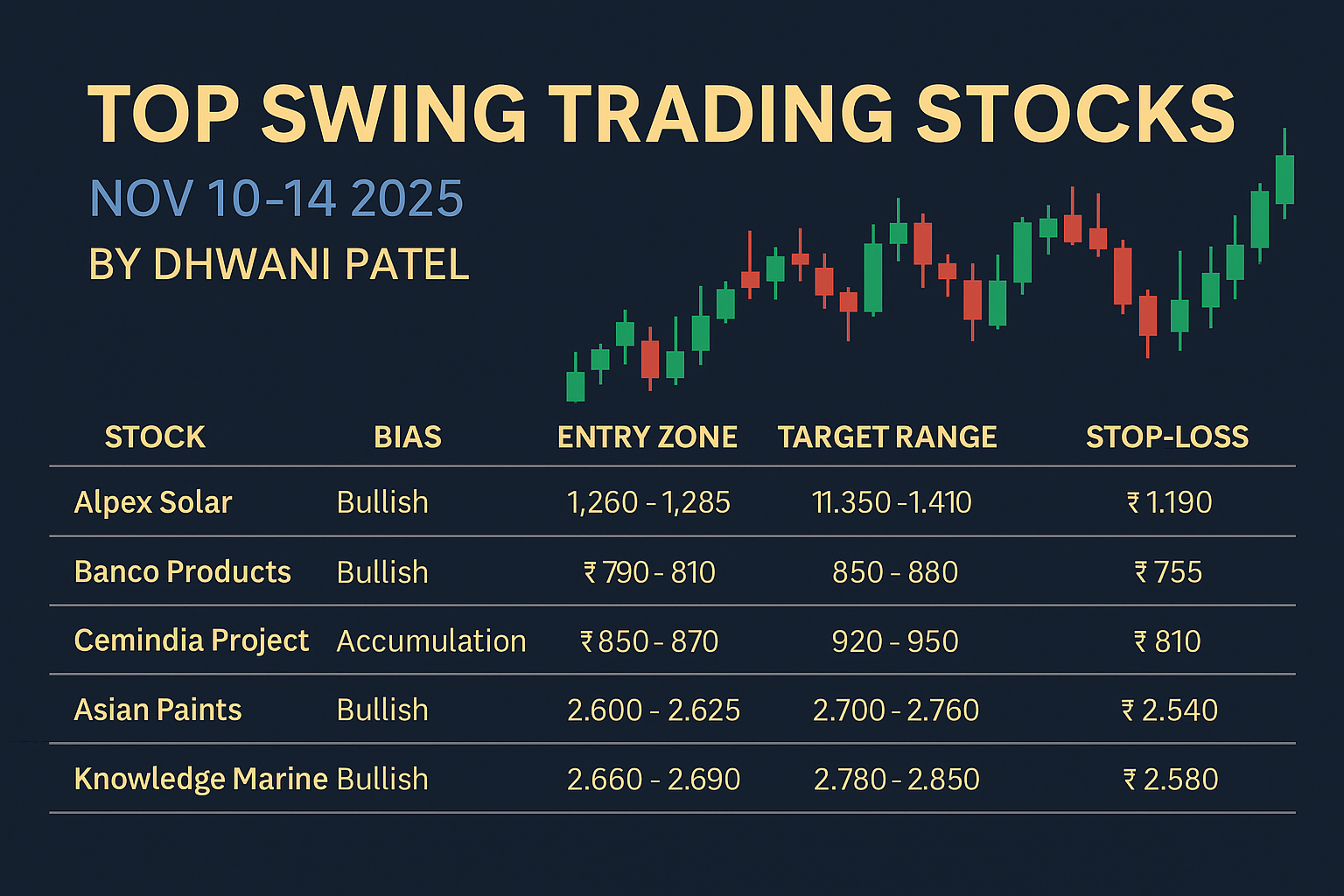

Top Swing Trading Stocks for This Week (Nov 10–14, 2025) | Short-Term Trading Ideas by Dhwani Patel

Market Outlook After a volatile start to November, Indian equities are hovering near critical support zones. The Nifty 50 has been consolidating below 25,600, and momentum indicators hint at short-term range-bound action.This environment is ideal for swing traders, where selective stock-specific strength offers high-probability opportunities. Below are five top swing trading stocks chosen for the week based on price action, volume surge, RSI, MACD, and short-term momentum. 1. Alpex Solar Ltd (CMP ₹ 1,280) Setup: A strong uptrend continues after a brief consolidation. Price has retested its breakout zone near ₹1,250 and bounced sharply on rising volume. 2. Banco Products India Ltd (CMP ₹ 798) Setup: The stock has broken a short-term falling channel and now trades above its 20- and 50-day EMAs. 3. Cemindia Project Ltd (CMP ₹ 856) Setup: Price has been consolidating for 10 days and is now showing an upward breakout with 9% rise in ROCE. 4. Asian Paints Ltd (CMP ₹ 2,613) Setup: After multiple tests near ₹ 2,570 support, the stock has formed a bullish hammer pattern. 5. Knowledge Marine & Engineering Works (CMP ₹ 2,678) Setup: Recently completed a flag pattern breakout above ₹ 2,600 with healthy volumes. Bonus Watchlist Stocks Strategy for the Week Dhwani Patel’s Swing Trading Insights “Discipline is the edge in swing trading — a clear plan, tight risk control, and objective exit levels define success. Traders should focus on stocks with consistent volume confirmation and breakout patterns.” Key Takeaways Stock Bias Entry Zone Target Range Stop-Loss Alpex Solar Bullish Continuation ₹ 1,260–1,285 ₹ 1,350–1,410 ₹ 1,190 Banco Products Bullish Reversal ₹ 790–810 ₹ 850–880 ₹ 755 Cemindia Project Accumulation Breakout ₹ 850–870 ₹ 920–950 ₹ 810 Asian Paints Bullish Rebound ₹ 2,600–2,625 ₹ 2,700–2,760 ₹ 2,540 Knowledge Marine Bullish Continuation ₹ 2,660–2,690 ₹ 2,780–2,850 ₹ 2,580 Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst.The information above is for educational and informational purposes only and does not constitute investment advice.Trading in securities involves risk of loss; consult your financial advisor before acting on any recommendation.

Trade Setup for 10 November 2025 by Dhwani Patel

Market Overview Indian markets ended the previous session on a mixed note, with volatility continuing to dominate investor sentiment. The Nifty 50 managed to hold key support levels and formed a bullish candle after three consecutive sessions of weakness, suggesting that buyers are gradually returning near lower zones. Despite this rebound, broader market participation remained limited as traders awaited fresh triggers amid global uncertainty. The Bank Nifty, however, outperformed the benchmark index, helping markets stabilize ahead of the new week. According to Dhwani Patel, the overall structure remains neutral-to-cautious, with Nifty yet to reclaim short-term moving averages. Sustained movement above resistance zones may revive momentum, while failure to do so could keep the market in a consolidation phase. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,492 Resistance (Pivot Points): 25,543 / 25,598 / 25,687Support (Pivot Points): 25,365 / 25,310 / 25,221 Market View The Nifty 50 formed a bullish candle with a long lower shadow and a minor upper shadow, reflecting strong buying at lower levels despite intermittent selling pressure. The index continues to trade below short-term moving averages and the midline of the Bollinger Band, but remains above medium- and long-term averages, indicating that the broader trend is still intact. Momentum indicators show cautious sentiment — the RSI stands at 49.16, and the MACD remains below the reference line, with the histogram further weakening.All of this suggests a bearish-to-neutral momentum, where follow-through buying above 25,600 could trigger a short-term reversal. Interpretation: Dhwani Patel observes that as long as Nifty holds above 25,350, intraday dips may attract buying. A decisive close above 25,600 would be the first sign of recovery. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 57,877 Resistance (Pivot Points): 58,001 / 58,200 / 58,522Support (Pivot Points): 57,356 / 57,157 / 56,835 Resistance (Fibonacci Retracement): 58,735 / 60,142Support (Fibonacci Retracement): 57,394 / 56,662 Market View The Bank Nifty led the recovery, gaining 323 points and forming a bullish candle with upper and lower shadows — signaling renewed buying interest and intraday volatility. The index climbed back above short-term moving averages and the midline of the Bollinger Band, hinting at improving momentum.The RSI moved higher to 60.03, though it still holds a bearish crossover, while the MACD remained below its reference line, reflecting cautious optimism. Interpretation: Dhwani Patel suggests that traders should closely monitor the 58,000 mark. A strong close above it could trigger follow-up buying, while a fall below 57,300 would weaken sentiment again. Setup 3 — Nifty Options Data Interpretation: The options data indicates a sideways trading range for Nifty between 25,350–25,700, with positional resistance around 25,700. Setup 4 — Bank Nifty Options Data Interpretation: Bank Nifty options suggest a range-bound move between 57,300–58,500, with bullish bias emerging above 58,000. Setup 5 — Sectoral Trends Dhwani Patel notes that sectoral rotation continues, and traders should focus on financials and autos for intraday opportunities. Setup 6 — India VIX The India VIX dipped 1.5% to 12.12, suggesting lower volatility and improved market confidence.A sustained move below 12 may continue to support a short-term recovery. Setup 7 — Intraday Outlook Index Bullish Above Bearish Below Range Nifty 50 25,600 25,350 25,350–25,700 Bank Nifty 58,000 57,300 57,300–58,500 Strategy by Dhwani Patel Setup 8 — Finversify Market Insight The Trade Setup for 10 November 2025 indicates a cautious recovery following a weak week.With Nifty stabilizing near support and Bank Nifty showing resilience, traders can expect range-bound movement with bullish undertones if buying continues above key short-term averages. However, sustained rejection near resistance levels may keep the market volatile and prevent a breakout in the short term. Key Takeaways Disclosure & Disclaimer: DHWANI PATEL (SEBI Registration No: INH200008608) is a SEBI Registered Research Analyst. The report is for informational and educational purposes only and does not constitute investment advice. Trading and investing involve risk; consult a qualified advisor before taking positions.