Introduction The Indian markets took a brief pause on October 30, with both Nifty 50 and Bank Nifty facing mild selling pressure after several sessions of strong gains. The indices showed fatigue near higher levels as traders opted for profit booking ahead of the weekly expiry. While the broader trend remains constructive, early signs of short-term consolidation have begun to appear. In this Trade Setup for 31 October 2025, Dhwani Patel, SEBI registered research analyst, shares the key pivot levels, momentum indicators, and option data shaping today’s outlook. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,878 Market Outlook:The Nifty 50 formed a bearish candle on the daily charts and slipped below its 5-day EMA, a technical sign of short-term caution. However, the index remains well above its 20-day and 50-day moving averages, keeping the broader structure intact. The RSI dropped to 64.14, showing weakening momentum, and the Stochastic RSI also indicated a negative crossover, reinforcing near-term fatigue. The MACD continued to maintain its bullish crossover, though the histogram has been gradually narrowing — a classic signal of momentum loss. Interpretation: From a Nifty futures trading guide perspective, traders should adopt a cautious stance — prefer buying dips with stop-losses rather than chasing breakouts. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,031 Market Outlook:The Bank Nifty mirrored Nifty’s pattern, forming a bearish candle with an upper shadow, reflecting selling pressure at higher levels. The index is still comfortably above all major moving averages, which continue to trend northward — a reminder that the larger trend remains positive despite the current pullback. The RSI eased to 66.98, while both the Stochastic RSI and the MACD histogram showed weakening momentum. The MACD, however, maintains its bullish crossover, suggesting that the weakness is corrective rather than structural. Interpretation: For those following index futures trading strategies India, a mixed-to-cautious tone is advised — long positions should be lightened near resistances, while new entries should be on pullbacks. Setup 3 — Nifty Call Options Data Interpretation:The 26,000 level has become a decisive ceiling for the market, with traders aggressively writing Calls at this strike. Until a clear breakout occurs, upward movement could remain capped near 26,100. Setup 4 — Nifty Put Options Data Interpretation:The 25,700–25,800 zone is emerging as the base support for the Nifty, suggesting that dips toward these levels could see strong buying interest. However, a break below this range could attract short-term selling pressure. Setup 5 — Bank Nifty Call Options Data Interpretation:Strong Call writing at 58,500 confirms that the index could face a temporary hurdle at this zone. Intraday momentum may remain limited unless a breakout above 58,550 occurs with strong volumes. Setup 6 — Bank Nifty Put Options Data Interpretation:Put writers remain confident near 57,800–57,500, reflecting that downside risk remains contained for now. However, sustained selling below 57,700 could invite more volatility. Setup 7 — India VIX (Volatility Index) India VIX: 11.98 (+0.9%) Volatility edged slightly higher, hinting at a bit of nervousness among traders. The fear gauge remains within the comfort zone, but a rise beyond 13 could change sentiment sharply. As Dhwani Patel points out,“A stable VIX means calm traders — but complacency can turn quickly if risk isn’t respected.” Setup 8 — Sectoral Outlook For swing trading strategies India, it’s time to focus on high-conviction trades rather than broad participation. Selectivity will outperform aggression in this phase. Setup 9 — Intraday Playbook Index Bullish Above Bearish Below Neutral Zone Nifty 50 26,034 25,803 25,850–26,000 Bank Nifty 58,326 57,915 58,000–58,250 Strategy: Setup 10 — Dhwani Patel’s View “Momentum is slowing, not reversing. The market is catching its breath — and that’s healthy for a sustained trend.” The Trade Setup for 31 October 2025 reflects a cautious yet intact bullish structure. As long as Nifty stays above 25,700 and Bank Nifty above 57,500, traders can remain constructive but must reduce leverage and protect profits. Key Takeaways Final Thoughts After weeks of consistent gains, the market is displaying signs of short-term fatigue. The tone remains positive, but this phase calls for patience and precision. Traders should treat this as a cooling period, not a reversal. As Dhwani Patel often emphasizes — “When markets slow down, traders shouldn’t — they should sharpen their discipline instead.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information provided is for educational purposes only and should not be interpreted as investment or trading advice. Markets involve risk — readers are advised to conduct their own analysis before trading or investing.

Adani Energy Solutions Rises ~7% on Strong Broker Ratings – What Investors Should Know

1. Market Overview On October 29, 2025, Adani Energy Solutions Ltd (AESL) witnessed a strong rally in trade, climbing nearly 7% intraday before settling around ₹967 per share. The surge came after several leading brokerage firms issued bullish reports on the stock, projecting notable upside potential based on its expanding presence in India’s transmission and smart-metering markets. Despite a recent dip in quarterly profit, the broader sentiment around the company remains positive, with investors betting on long-term structural growth in the power infrastructure sector. 2. What Triggered the Rally The primary reason behind the rally was a series of upgraded brokerage recommendations highlighting the company’s solid business fundamentals and upcoming project pipeline. Analysts noted: The combination of these factors triggered renewed buying interest from both retail and institutional investors. 3. Recent Financial Snapshot In its recent quarterly update for Q2 FY26, AESL reported: While the decline in profit raised some short-term concerns, analysts attributed it largely to non-recurring items and higher finance costs, not operational weakness. The revenue growth, combined with steady project execution, reinforced the company’s long-term potential. 4. Sector Tailwinds and Growth Outlook The Indian government’s ongoing emphasis on green energy corridors, grid modernization, and smart metering continues to provide a major tailwind for companies like Adani Energy Solutions. Key sector drivers include: AESL’s diversified presence in both transmission and distribution segments gives it a strong edge to capture a significant share of upcoming opportunities. 5. Technical Perspective From a technical standpoint, AESL’s chart structure indicates a renewed bullish breakout after weeks of consolidation. If the stock sustains above ₹985, analysts expect a potential move toward ₹1,080–₹1,120 levels in the near term. 6. Investor & Trader View For long-term investors, the outlook on Adani Energy Solutions remains constructive given: For short-term traders, volatility may persist due to profit-booking, but the overall trend remains positive as long as the stock holds above key support levels. 7. Key Risks to Watch While the momentum is strong, a few risks remain: Monitoring order inflows and balance-sheet stability will be critical to assess sustainability of current optimism. 8. Conclusion The nearly 7% surge in Adani Energy Solutions on October 29 highlights the market’s confidence in its long-term business fundamentals.Despite short-term earnings softness, the company continues to attract strong institutional interest, backed by positive broker outlooks and India’s growing energy infrastructure needs. For investors, the message is clear — Adani Energy Solutions remains one of the key players driving India’s power transmission and smart-meter revolution, making it a stock to watch in the evolving energy landscape.

Trade Setup for 30 October 2025 by Dhwani Patel

Introduction Indian equities extended their upward journey on October 29, with both Nifty 50 and Bank Nifty closing higher, supported by firm buying in banking, financials, and auto sectors. After a brief pause in the previous session, the market resumed its positive trajectory, indicating sustained strength across broader indices. In this Trade Setup for 30 October 2025, Dhwani Patel, SEBI registered research analyst, breaks down the key support and resistance levels, derivative data, and 10 setups that define today’s market tone. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 26,054 Market Outlook:The Nifty 50 formed a bullish candle with a small upper wick, indicating strength with only minor profit booking around the 26,100 mark. Importantly, volumes were above average — reinforcing conviction among buyers. All major moving averages remain in a rising alignment, reflecting a strong trend structure. The RSI climbed further to 72.43, suggesting strong momentum but also mild overbought conditions. The MACD continued its bullish slope with a positive histogram above the zero line. Interpretation: For followers of the Nifty futures trading guide, this structure suggests holding long positions with disciplined stop-loss placement rather than chasing late entries. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,385 Market Outlook:The Bank Nifty displayed resilience once again, forming a bullish candle with a long lower shadow — a strong sign of dip buying. The index remains comfortably above all major moving averages, each trending higher, confirming structural strength. Momentum indicators continue to support the positive tone. The RSI, now at 74.19, indicates an overextended but intact trend, while the MACD continues to maintain a bullish crossover with a rising histogram. Interpretation: The banking sector remains the backbone of the current uptrend — ideal for index futures trading strategies India that focus on momentum alignment with trailing profit locks. Setup 3 — Nifty Call Options Data Interpretation:Call writers continue defending 26,100–26,500, reflecting caution near psychological barriers. However, lack of significant unwinding at lower strikes suggests confidence in the ongoing bullish structure. Setup 4 — Nifty Put Options Data Interpretation:Heavy Put writing at 25,900 confirms that traders are confident in defending the current support. The balance between call and put positioning hints at consolidation between 25,900–26,200 before the next move. Setup 5 — Bank Nifty Call Options Data Interpretation:Call writers are active at higher levels, implying cautious optimism. Breakout traders should wait for a decisive move above 58,550–58,600 for clean upward momentum. Setup 6 — Bank Nifty Put Options Data Interpretation:Put writers remain aggressive near 58,000, turning this into a key inflection point. As long as this zone holds, the short-term sentiment remains decisively bullish. Setup 7 — Volatility Index (India VIX) India VIX: 11.83 (–1.0%) Volatility remained stable and below the key 13 threshold, indicating steady market confidence. This low-volatility environment continues to favor trend-following strategies. As Dhwani Patel notes,“Low volatility rewards discipline. The quieter the market looks, the sharper the opportunity it hides.” Setup 8 — Sectoral Overview For swing trading strategies India, sector rotation remains key. Focus on large-cap leaders rather than chasing small-cap volatility. Setup 9 — Intraday Plan Index Bullish Above Bearish Below Neutral Zone Nifty 50 26,122 25,952 25,980–26,080 Bank Nifty 58,551 58,078 58,200–58,400 Strategy: Setup 10 — Dhwani Patel’s View “The market isn’t overextended — it’s confident. Momentum is strong, but sustainability comes from selective participation, not blind optimism.” The Trade Setup for 30 October 2025 reflects a continuation of the bullish structure with Nifty holding above 25,900 and Bank Nifty staying firm above 58,000. Both indices are likely to maintain an upward bias, though intraday volatility near resistances cannot be ruled out. Key Takeaways Final Thoughts Markets continue to demonstrate remarkable stability and strength, supported by strong domestic flows and global resilience. Traders should remain with the trend but adopt disciplined position sizing as indices approach round-number resistances. As dhwani patel says — “In bull markets, fear hides in overconfidence — and discipline is the only cure.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The analysis shared here is intended purely for educational purposes and should not be construed as investment or trading advice. Financial markets involve risk — readers are advised to perform due diligence or consult certified professionals before making trading or investment decisions.

Trade Setup for 29 October 2025 by Dhwani Patel

Introduction The domestic equity market closed Monday’s session on a mixed note, as Nifty 50 paused near the psychological mark of 26,000, forming a pattern that suggests short-term indecision. Meanwhile, Bank Nifty extended its gains modestly, holding firmly above 58,000 levels — a sign that the bullish undertone remains alive, even as traders wait for fresh triggers ahead of expiry week. In this Trade Setup for 29 October 2025, dhwani patel, SEBI registered research analyst, outlines the key levels, derivative data, and technical outlook for both indices. The goal: help traders plan effectively amid ongoing consolidation and moderate volatility. Nifty 50: Key Resistance & Support Levels Nifty Close: 25,936 Market Outlook:The Nifty formed a Doji candle on the daily chart — a sign that buyers and sellers reached a temporary equilibrium after recent bullish momentum. While the candle indicates indecision, the broader structure continues to favor the bulls. All major moving averages, from 5-day EMA to 100-day SMA, are aligned upward, confirming a strong intermediate uptrend. The 5-day EMA continues to act as an immediate dynamic support since early October. The RSI remains elevated at 70+, showing persistent buying strength, while the MACD continues to rise with a healthy histogram above the zero line. Interpretation: For those following the Nifty futures trading guide, this is a time to trail stops and stay aligned with the dominant trend instead of pre-empting reversals. Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,214 Market Outlook:The Bank Nifty outperformed Nifty, forming a bullish candle with a visible lower shadow, indicating strong buying on dips. It added around 100 points, maintaining leadership within the broader market. Technically, the index remains above all key moving averages, with each one trending northward. The RSI at 72.88 reflects overbought but steady conditions — a sign of strength rather than exhaustion. The MACD continues to support the positive bias, with its histogram comfortably above zero. Interpretation: From an index futures trading strategies India standpoint, traders can maintain a buy-on-dips approach with a stop-loss below 57,700 and a potential upside target near 58,700–59,000. Setup 3 — Nifty Call Options Data Interpretation:Heavy Call writing at 26,000 indicates that this level could act as a near-term ceiling unless a strong breakout occurs. Traders appear to be building defensive positions at higher strikes, preparing for range-bound activity ahead of expiry. Setup 4- Nifty Put Options Data Interpretation:Put writers have been aggressive around 25,500–26,000, confirming solid demand zones. This suggests that bulls are willing to defend the lower half of the current range with conviction. Setup 5 — Bank Nifty Call Options Data Interpretation:Call writers have started building positions in the 58,000–58,500 range, suggesting mild resistance near current market levels. However, the absence of major unwinding at lower strikes shows traders’ confidence that the trend remains stable. Setup 6 — Bank Nifty Put Options Data Interpretation:Strong Put writing at 58,000 signals that this level is now a firm support. Any short-term decline toward this area could see renewed buying. Setup 7 — India VIX (Volatility Index) India VIX: 11.95 (+0.8%) Volatility has been inching higher but remains comfortably below the danger zone of 13–14. This level keeps market participants optimistic while providing enough room for short-term swings. As dhwani patel explains,“When volatility creeps up but doesn’t break thresholds, it signals controlled caution — the kind of backdrop where disciplined traders thrive.” Setup 8 — Sectoral Snapshot For swing trading strategies India, sector rotation between banks and autos is expected to continue dominating short-term price action. Setup 9 — Intraday Trade Plan Index Bullish Above Bearish Below Neutral Zone Nifty 50 26,072 25,786 25,850–26,000 Bank Nifty 58,435 57,764 57,900–58,300 Strategy: Setup 10 — Dhwani Patel’s View “When markets pause after a rally, it’s not fatigue — it’s composure. True trends mature through patience, not panic.” The Trade Setup for 29 October 2025 reflects short-term indecision with a broader bullish context. Both indices remain above key moving averages, and derivatives positioning confirms that buyers still have control. Nifty’s immediate range: 25,800–26,100Bank Nifty’s short-term range: 57,800–58,600 The base formation at these levels suggests that any dip toward supports is likely to attract fresh buying. Key Takeaways Final Thoughts With both Nifty and Bank Nifty sustaining above crucial moving averages, the broader trend remains bullish, though momentum is temporarily easing. Traders should avoid overleveraging and instead capitalize on controlled volatility through disciplined setups. As Dhwani Patel puts it: “Strong markets don’t need constant rallies — they need consistent conviction.” Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information shared here is intended for educational purposes only and should not be construed as investment or trading advice. Market participation carries inherent risks — readers are advised to perform due diligence or seek professional advice before acting on any information.

Trade Setup for 28 October 2025 by Dhwani Patel

Introduction The Indian equity markets started the final week of October on a firm note, with Nifty 50 reclaiming ground above 25,900 and Bank Nifty extending gains after last week’s mild profit booking. Both indices showed resilience despite intraday volatility, supported by strong sectoral rotation and consistent institutional flows. In this Trade Setup for 28 October 2025, Dhwani Patel, SEBI registered research analyst, shares the updated Nifty and Bank Nifty levels, key derivative data, and 10 detailed setups to guide traders ahead of the opening bell. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,966 Market Outlook:Nifty ended Monday with a bullish candle accompanied by a small upper wick — an indication of intraday profit booking near the 26,000 mark, yet a continuation of underlying buying strength. The index remains well above all key moving averages, which continue to trend upward. The RSI has edged higher to 71.49, indicating sustained momentum, while the MACD stays positive with the histogram holding firmly above zero. Interpretation: For Nifty futures trading guide followers, the market tone remains bullish, with opportunities to buy minor dips near support zones. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 58,114 Market Outlook:Bank Nifty added over 400 points and printed a bullish candle with short shadows, highlighting strong buying across leading banks. Momentum indicators remain constructive — the RSI at 72.11 confirms a rebound from the previous week’s cooling phase. The MACD continues to hold its positive crossover, though the Stochastic RSI suggests possible short-term consolidation before the next leg higher. Interpretation: From an index futures trading strategies India perspective, dips near 57,700 may offer an opportunity to re-enter long positions with defined stops. Setup 3 — Nifty Call Options Data Interpretation:Call writers are defending higher zones aggressively, especially between 26,100–26,500. The unwind at lower strikes reflects a possible transition from profit booking to reaccumulation — a bullish signal if follow-through buying appears. Setup 4 — Nifty Put Options Data Interpretation:Robust Put writing near 25,900–26,000 highlights that traders view this area as firm support. Any dips into this zone are likely to attract fresh buying interest. Setup 5 — Bank Nifty Call Options Data Interpretation:Call writing at 58,200–58,900 indicates short-term overhead supply. A decisive breakout beyond 58,500 could trigger short covering toward 59,000–59,200. Setup 6 — Bank Nifty Put Options Data Interpretation:Put writers have established a firm floor at 58,000, showing traders’ confidence in sustaining the bullish tone. Setup 7 — Volatility Index (India VIX) India VIX: 11.86 (+2.31%) Volatility edged higher, but still stays below the comfort threshold of 13–14. This continues to favor the bulls, though traders should remain alert for sharp intraday swings as expiry approaches. “Markets may look calm on the surface, but volatility builds quietly beneath it,” notes Dhwani Patel. Setup 8 — Sectoral Trends For swing trading strategies India, maintaining focus on large-cap banking and auto counters offers strong short-term setups. Setup 9 — Intraday Playbook Index Bullish Above Bearish Below Neutral Zone Nifty 50 26,044 25,822 25,880–26,000 Bank Nifty 58,351 57,644 57,800–58,200 Strategy: Setup 10 — Dhwani Patel’s View “Momentum is healthy and participation is broad-based. Small consolidations are the price markets pay for stability — not a signal of weakness.” The Trade Setup for 28 October 2025 reaffirms strength in both indices, with Nifty holding above 25,900 and Bank Nifty defending 58,000. Short-term volatility may continue, but the primary trend stays upward. Key Takeaways Final Thoughts With both indices trading above key moving averages and option data confirming strong support at lower levels, the trend remains favorable for positional traders. Minor pullbacks can be used to accumulate quality positions in leading sectors. As Dhwani Patel summarizes — “A calm trend hides opportunity. Focus on structure, not noise.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information provided is for educational purposes only and should not be interpreted as investment or trading advice. Markets involve risk — readers are advised to conduct their own analysis before trading or investing.

Swing Trading Stocks This Week (October 27–31, 2025): Top Stocks to Watch

Market Outlook: Consolidation Before the Next Leg Up As we enter the final week of October 2025, the Indian equity market remains in a healthy consolidation phase after hitting record highs earlier this month. The Nifty 50 continues to trade above 25,700, while the Bank Nifty has maintained strength near 57,700 levels, despite intermittent profit booking. The broader market sentiment remains constructive, supported by stable corporate earnings, a firm rupee, and declining crude oil prices. However, traders should stay selective as momentum oscillators like RSI and Stochastic RSI are showing mild cooling signals on daily charts. For swing traders, this environment presents opportunities to ride short-term price moves within well-defined risk parameters. Finversify’s technical screeners have identified the best swing trading stocks for October 27–31, 2025, based on momentum strength, relative volume, and favorable chart structures. Selection Criteria: How Finversify Filters Swing Trading Stocks To shortlist the top candidates for this week’s swing trades, our research team applied a multi-layer technical and quantitative approach, considering: This led to 10 high-probability setups for the week. Top Swing Trading Stocks This Week (October 27–31, 2025) Stock Name LTP (₹) Change % Market Cap (₹ Cr) 1M Return 3M Return Hindalco Industries 824.45 +5.03% 1,85,273 10.53% 18.56% Cholamandalam Investment 1,733.60 +2.90% 1,45,865 6.34% 11.74% Shriram Finance 715.45 +2.91% 1,34,577 13.78% 9.39% Cummins India 4,183.20 +2.68% 1,15,958 4.87% 17.38% Indian Bank 820.05 -0.74% 1,10,458 15.79% 25.75% MRF 1,60,190 -0.92% 67,939 2.73% 6.85% Motilal Oswal Financial Services 1,036.20 +1.57% 62,215 9.80% 14.51% Federal Bank 227.40 -0.02% 55,946 16.54% 6.86% Allied Blenders & Distillers 618.35 -1.14% 17,296 15.51% 31.37% Sammaan Capital 188.25 +7.50% 15,594 39.42% 40.19% Jain Resource Recycling 400.22 +8.40% 13,811 25.83% 25.83% Hindalco Industries (₹824.45) Sector: Metals & Mining | Market Cap: ₹1.85 Lakh Cr Technical View:Hindalco has broken out from a two-week consolidation pattern with a strong 5% surge in volume. The price has reclaimed its 20-day EMA, signaling renewed buying interest. Indicators: RSI at 68 and MACD bullish crossover support the uptrend. Swing View: “Hindalco’s rally is backed by strong base metal prices and rising global aluminum demand.” — Finversify Research Cholamandalam Investment (₹1,733.60) Sector: NBFC | Market Cap: ₹1.45 Lakh Cr Technical View:After holding firm above ₹1,700, Chola Finance is showing a steady trend continuation pattern. The 20-day EMA at ₹1,685 is acting as strong support. Momentum Indicators: RSI at 62 and Stochastic crossover confirm continuation bias. Swing View: NBFCs continue to outperform as credit growth and disbursements remain strong in Q2 earnings. Shriram Finance (₹715.45) Sector: Financial Services | Market Cap: ₹1.34 Lakh Cr Technical View:Shriram Finance formed a bullish engulfing candle on the daily chart, indicating reversal from short-term support near ₹700. Volume Surge: Over 60 million shares traded — nearly double its 10-day average. Swing View: Strong rural demand and improving credit recovery trends make Shriram Finance a steady swing pick. Cummins India (₹4,183.20) Sector: Capital Goods | Market Cap: ₹1.15 Lakh Cr Technical View:Cummins India is forming a continuation flag pattern near its all-time high. The 50-day EMA at ₹3,980 is a key support level. Momentum: RSI at 65; MACD histogram positive. Swing View: Industrial stocks like Cummins are likely to benefit from capital expenditure cycles and infrastructure demand. Indian Bank (₹820.05) Sector: PSU Bank | Market Cap: ₹1.10 Lakh Cr Technical View:Indian Bank is witnessing short-term profit booking after strong 1-month gains of 15.79%. The overall trend remains positive above ₹800. Swing View: PSU banks continue to lead the market recovery on improved NPA ratios and robust credit growth. MRF (₹1,60,190) Sector: Auto | Market Cap: ₹67,939 Cr Technical View:MRF remains in a sideways consolidation between ₹1,55,000 and ₹1,63,000. A breakout above ₹1,62,500 may attract momentum buying. Swing View: Tyre demand and falling rubber prices make MRF a potential medium-term outperformer. Motilal Oswal Financial Services (₹1,036.20) Sector: Brokerage | Market Cap: ₹62,215 Cr Technical View:MOFS has given a clean breakout above ₹1,020 with a rising volume structure and positive RSI divergence. Swing View: With strong inflows into mutual funds and growing demat accounts, brokerage firms remain on solid footing. Federal Bank (₹227.40) Sector: Banking | Market Cap: ₹55,946 Cr Technical View:Federal Bank is consolidating near the ₹225 zone. The 1-month return of 16.5% suggests momentum remains strong despite minor pullbacks. Swing View: Stable asset quality and retail loan growth keep Federal Bank among the top swing trading candidates. Allied Blenders & Distillers (₹618.35) Sector: Consumer | Market Cap: ₹17,296 Cr Technical View:ABD has been showing strong follow-up buying after a 30% three-month rally. The trend remains bullish as long as it holds ₹600. Swing View: Premium liquor category expansion and festive demand could boost Q4 performance. Sammaan Capital (₹188.25) Sector: Financial Services | Market Cap: ₹15,594 Cr Technical View:Sammaan Capital has surged over 7.5% in a day and delivered 40% returns in three months. RSI is in overbought territory but trend remains up. Swing View: The stock’s strong volume breakout suggests institutional accumulation; traders should trail stops to protect profits. Bonus Pick: Jain Resource Recycling (₹400.22) Sector: Recycling | Market Cap: ₹13,811 Cr Technical View:Jain Resource Recycling has broken out from a consolidation base with 8.4% daily gain and a strong 25% monthly rally. Swing View: Circular economy-focused businesses like Jain Recycling are gaining investor traction amid sustainability themes. Market Sentiment Summary Finversify View According to Dhwani Patel, Head of Research at Finversify: “Swing traders should maintain a stock-specific approach this week. Momentum remains intact, but rotation is happening between large caps and midcaps. Focus on high-volume breakouts with defined stop-losses.” She adds that traders must avoid chasing overextended rallies and instead focus on stocks with fresh volume confirmations and tight consolidation breakouts. Conclusion: Swing Smart, Trade Disciplined The week of October 27–31, 2025, offers multiple swing opportunities across sectors — from Hindalco’s metal strength to Cholamandalam’s NBFC stability. Swing trading success this week will depend on disciplined execution, dynamic position sizing, and adherence to stop-loss levels. Keep tracking Finversify’s daily market insights for live setups, key index levels, and real-time updates on market breadth

IPOs This Week: Five New Public Issues Set to Open for Subscription from October 27

Primary Market Regains Momentum After a short lull in the primary market, investor activity is set to pick up again with a fresh wave of public issues. Starting October 27, 2025, the week will witness five new IPOs across mainboard and SME segments, collectively expected to raise over ₹45,000 crore this month. This renewed activity follows strong investor participation earlier in October in issues like Tata Capital and LG Electronics, which together raised over ₹27,000 crore. Orkla India IPO: The Spice and Convenience Food Giant The most anticipated among the new entrants this week is Orkla India, the parent company behind popular food brands MTR Foods, Eastern Condiments, and Rasoi Magic. The Bengaluru-based company’s IPO will consist of 2.28 crore shares offered for sale by Orkla Asia Pacific, along with shareholders Navas Meeran and Feroz Meeran.Since it’s a complete OFS, all proceeds will go to the existing shareholders — not the company itself. This issue reflects Orkla’s effort to enhance liquidity and visibility in India’s fast-growing packaged food sector. Studds Accessories IPO: Riding on Helmet Market Growth The second major listing is Studds Accessories, one of India’s leading helmet and motorcycle accessories manufacturers. This IPO will allow promoters and existing investors to partially exit while bringing the company into the public market spotlight.Studds’ brand recognition and strong export footprint could attract retail and HNI investors seeking exposure to India’s two-wheeler growth story. Lenskart Solutions IPO: Vision for a Digital Future Eyewear major Lenskart Solutions Ltd is also hitting the market this week, with one of the most significant issues of the season. The IPO includes the sale of 12.75 crore shares by existing promoters and investors.Recently, billionaire investor Radhakishan Damani acquired a 0.13% pre-offer stake, further boosting market interest. Lenskart’s mix of digital-first strategy and physical retail expansion positions it among India’s most exciting consumer-tech plays in 2025. Jayesh Logistics IPO: SME Segment Spotlight From the SME segment, Jayesh Logistics Ltd will be the first to open for subscription this week. The company plans to use the IPO proceeds to: Jayesh Logistics, valued slightly above ₹100 crore, aims to strengthen its operational efficiency and digital infrastructure. Game Changers Texfab IPO: Textile Innovation from Delhi Another SME listing this week is Game Changers Texfab Ltd, a Delhi-based textile supplier catering to fashion designers, garment exporters, and retail chains. The company plans to utilize funds for capacity expansion, working capital needs, and other corporate purposes.Its focus on high-quality fabric solutions positions it well in India’s growing garment manufacturing sector. Cumulative Fundraising & Market Context October 2025 has turned out to be one of the most active IPO months of the year.So far, 10 IPOs have already hit the markets, including seven from the mainboard segment, raising nearly ₹35,791 crore. With these five new issues, the total fundraising is set to cross ₹45,000 crore this month — signaling strong investor appetite despite global volatility. Experts believe the mix of consumer-focused, manufacturing, and SME listings shows healthy market depth. Retail participation has also remained high in both large-cap and SME offerings. Finversify Outlook According to Dhwani Patel , Head of Research at Finversify, the recent IPO momentum reflects the revival of domestic investor confidence and a broader shift toward capital-market participation. “The diversity of upcoming IPOs — from food to logistics to consumer tech — signals balanced sectoral interest.But investors should focus on fundamentals and valuations, not just subscription buzz.” She also adds that while short-term listing gains may attract traders, long-term value lies in quality businesses with sustainable growth, like Lenskart and Orkla India. Quick Recap: IPOs Opening This Week Company Segment Dates Issue Size (₹ crore) Type Price Band (₹) Orkla India (MTR Foods) Mainboard Oct 29–31 1,667.5 Offer-for-Sale 695–730 Studds Accessories Mainboard Oct 30–Nov 3 — Offer-for-Sale TBD Lenskart Solutions Mainboard Oct 31–Nov 4 7,278 (approx.) Fresh + OFS 402 (expected) Jayesh Logistics SME Oct 27–29 28.63 Fresh Issue 116–122 Game Changers Texfab SME Oct 28–30 55 Fresh Issue 96–102 Final Thoughts The IPOs this week offer a diverse range of opportunities — from large-cap consumer brands to high-growth SMEs.Investors looking for short-term trading potential can track listing-day premiums, while long-term investors should assess financials, sector demand, and growth prospects before subscribing. With October’s total IPO fundraising likely exceeding ₹45,000 crore, the Indian primary market remains one of the most dynamic in Asia. For expert-backed IPO analysis, live market updates, and rule-based trading insights, visit Finversify — your trusted source for data-driven investment research. Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The views expressed are educational in nature and not investment recommendations. Trading in financial markets involves risk. Please conduct your own research before making any investment or trading decision.

Trade Setup for 27 October 2025 by dhwani patel

Introduction After several sessions of steady upward movement, Indian equities showed visible signs of fatigue on October 24, as both Nifty 50 and Bank Nifty encountered selling pressure at higher levels. Traders booked profits near resistance zones, leading to a mild correction. Despite this short-term weakness, both indices remain comfortably above their key moving averages, indicating that the broader structure is still bullish. In this Trade Setup for 27 October 2025, dhwani patel, SEBI registered research analyst, analyzes the Nifty and Bank Nifty levels, options data, and key setups to help traders plan their strategy for the upcoming session. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,795 Market Outlook:Nifty formed a long bearish candle with a small lower wick, indicating sustained selling pressure. This price action broke the six-day higher-high pattern visible on the daily chart, although the weekly trend remains upward. Momentum indicators show early signs of cooling. The RSI slipped to 67.92, and the Stochastic RSI triggered a bearish crossover — implying fatigue in momentum. However, the MACD remains on a positive crossover with the histogram still above zero, confirming that the larger uptrend remains intact. Interpretation: For those following the Nifty futures trading guide, traders can stay cautiously bullish with tight stop-losses below 25,590. Setup 2 — Bank Nifty: Key Resistance & Support Levels Bank Nifty Close: 57,700 Market Outlook:After touching a record high, the Bank Nifty reversed to form a bearish candle with a lower wick — reflecting intraday volatility and ongoing profit-booking. The pattern shows a lower high–lower low formation, signaling short-term exhaustion after a strong run-up. Momentum is fading slowly. The RSI near 68.69 is approaching a support zone, while the Stochastic RSI has entered a bearish crossover. Despite this, the MACD remains positive and key moving averages continue to slope upward. Interpretation: For traders using index futures trading strategies India, dips near 57,400 remain ideal accumulation points for positional setups. Setup 3 — Nifty Call Options Data Interpretation:Call writers are aggressively defending 26,000–26,500, indicating a strong supply zone. This range will remain a key hurdle for Nifty unless it breaks out with volume and momentum. Setup 4 — Nifty Put Options Data Interpretation:Strong Put buildup near 25,700–25,800 suggests buyers are defending this zone actively. As long as these levels hold, downside risk remains limited. Setup 5 — Bank Nifty Call Options Data Interpretation:Profit-booking was visible in higher strikes, with fresh writing around 58,000–59,000. These levels will likely cap upside unless momentum returns with strong volumes. Setup 6 — Bank Nifty Put Options Data Interpretation:Put writers remain active near 57,000, confirming that traders are still betting on the continuation of the bullish structure. Setup 7 — Put-Call Ratio (PCR) Nifty PCR: 0.76 (down from 0.95) A falling PCR signals short-term caution as Call writing has increased. However, the ratio is still above oversold territory, implying consolidation rather than outright weakness. Setup 8 — India VIX India VIX: 11.59 (–1.21%) Volatility eased slightly and remains well within the bullish comfort zone. As long as VIX trades below 13, markets are unlikely to see major disruptions. As dhwani patel explains,“Low volatility hides the best trading setups — they emerge quietly while others wait for noise.” Setup 9 — Intraday Playbook Index Bullish Above Bearish Below Neutral Zone Nifty 50 25,906 25,680 25,750–25,850 Bank Nifty 58,092 57,341 57,500–57,900 Strategy: Setup 10 — dhwani patel’s View “Short-term pullbacks are part of strong trends. The key is to differentiate between profit booking and panic — markets often test your patience before rewarding it.” The Trade Setup for 27 October 2025 signals short-term consolidation within a larger bullish framework. Traders should monitor 25,700 on Nifty and 57,300 on Bank Nifty as crucial zones to gauge market direction. Key Takeaways Final Thoughts Markets are adjusting after a record run-up — a natural and necessary phase for sustainable momentum.For traders and investors following index futures trading strategies India, the focus should remain on managing exposure, respecting key supports, and letting the broader trend guide decision-making. As dhwani patel concludes: “Every correction tests conviction. The strongest hands stay steady while the weak hands seek certainty.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The views expressed are educational in nature and not investment recommendations. Trading in financial markets involves risk. Please conduct your own research before making any investment or trading decision.

Bharat Forge Shares Jump 4% on Army Order Reports: What It Means for Investors

Introduction Shares of Bharat Forge Ltd, one of India’s largest engineering and defence manufacturing companies, closed nearly 4% higher on 22 October 2025, following reports that the firm has emerged as the leading bidder for a major Indian Army order. The rally comes amid growing optimism around India’s defence manufacturing push, and traders are viewing this as a strong sign of Bharat Forge’s expanding presence beyond its traditional automotive business. At market close, the stock settled around ₹1,296 per share, up from ₹1,245 in the previous session, after touching an intraday high of approximately ₹1,311. What Triggered the Rally The stock’s sharp rise was fuelled by reports that Bharat Forge has been identified as the lowest (L1) bidder for a significant Indian Army procurement project — specifically for Close-Quarter Battle (CQB) carbines, a critical part of the Army’s modernization program. While the company clarified that no formal contract has yet been signed, it confirmed participation in the tender process and stated that contract discussions with the Ministry of Defence are in progress. This development positions Bharat Forge strategically in the defence weapons and systems manufacturing space, a sector seeing record allocations from the Indian government. Why the Market Reacted Positively Stock Performance Snapshot Parameter Details (22 Oct 2025) Closing Price ₹1,296 Intraday High ₹1,311 Intraday Low ₹1,245 Change (%) +4.1% 52-Week High / Low ₹1,385 / ₹810 Market Cap Approx. ₹60,000 crore Volume Surge Nearly 2× average daily volume The stock has gained over 35% in the past six months, supported by improved quarterly results and rising visibility in the defence segment. Expert Insights — Dhwani Patel According to Dhwani Shah Patel, Founder of Finversify, the surge in Bharat Forge’s share price highlights investor confidence in the company’s long-term transformation. “Bharat Forge’s expansion into defence is a major structural shift. Even if the contract is still in discussion, being the leading bidder in such a large procurement showcases strong technical and manufacturing credibility,” says Dhwani. She further notes that investors should avoid speculative buying purely on news flow, and instead focus on the company’s broader fundamentals and upcoming earnings. Short-Term vs Long-Term Outlook Short-Term View (1–2 weeks) The near-term momentum looks positive, but some profit-booking could occur after the sharp intraday rise. The ₹1,320–₹1,340 zone will act as key resistance, while ₹1,260 remains immediate support. Medium-Term View (3–6 months) If the Army contract is officially confirmed, analysts expect a re-rating of Bharat Forge’s defence division, potentially pushing the stock towards the ₹1,400–₹1,450 range. Long-Term View (12–18 months) With rising government defence spending, a strong export pipeline, and increasing diversification, Bharat Forge could become one of India’s top dual-sector (auto + defence) growth stories. Bharat Forge’s Defence Journey So Far This latest Army order buzz aligns perfectly with its long-term strategic vision to become a global defence manufacturing powerhouse from India. Risks & Considerations While investor sentiment is bullish, a few key factors need monitoring: Finversify Takeaway “Patience is key here,” adds Dhwani Patel. “Defence growth stories are slow but powerful — they build value quarter after quarter, not overnight.” Quick Summary Aspect Details Stock Name Bharat Forge Ltd Closing Price (22 Oct 2025) ₹1,296 Daily Change +4.1% Trigger Reports of major Indian Army order Status Company confirmed bid, contract not yet signed Outlook Positive with short-term volatility Finversify View Gradual accumulation for long-term portfolios Conclusion The 4% rise in Bharat Forge shares on 22 October 2025 signals growing confidence in India’s defence manufacturing transformation. Whether or not the final Army order is awarded soon, the company’s positioning as a key player in indigenous defence technology is already clear. As India accelerates its “Make in India” initiative for the armed forces, Bharat Forge could be among the biggest long-term beneficiaries — combining engineering excellence, government support, and global demand tailwinds. “From forging engines to forging national security — Bharat Forge’s next decade looks more strategic than ever,” concludes Dhwani Patel. Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information provided is for educational purposes only and does not constitute investment or trading advice. Trading in financial markets carries risk. Readers should perform their own analysis.

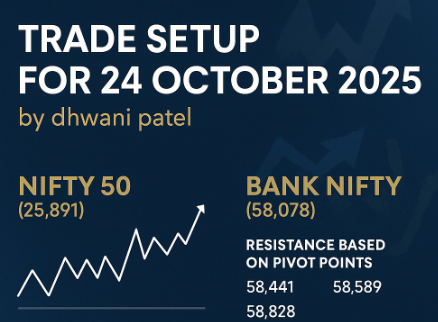

Trade Setup for 24 October 2025 by dhwani patel

Introduction After a week of steady gains and fresh record highs, the Indian markets showed signs of mild fatigue on October 23, as traders booked profits near the top. Both Nifty 50 and Bank Nifty witnessed intraday volatility, but the overall trend remains bullish — supported by rising moving averages, stable global cues, and consistent institutional inflows. In this Trade Setup for 24 October 2025, dhwani patel, SEBI registered research analyst, breaks down the key Nifty and Bank Nifty levels, along with option data, volatility trends, and 10 actionable setups to help traders plan their positions effectively. Setup 1 — Nifty 50: Key Resistance & Support Levels Nifty Close: 25,891 Market Outlook:Nifty formed a bearish candle with a small upper wick, indicating some selling at higher zones. However, the higher high–higher low pattern remains undisturbed — a sign that the uptrend is still healthy. The index continues to trade comfortably above all key moving averages, and momentum indicators like the RSI (in the 60–70 range) and a rising MACD suggest that underlying strength persists despite short-term consolidation. Interpretation: For traders following a Nifty futures trading guide, it’s a classic continuation phase — not an exit zone, but a time for patience and risk management. Setup 2 — Bank Nifty: Pivot & Fibonacci Levels Bank Nifty Close: 58,078 Market Outlook:Bank Nifty briefly surpassed 58,500, recording a new all-time high before encountering resistance. The day’s candle reflects selling pressure at intraday highs, but the broader uptrend remains fully intact. Moving averages continue their upward slope, and the RSI, elevated near 76, confirms strong momentum. The MACD also supports the positive trend, showing no early signs of reversal. Interpretation: For those applying index futures trading strategies India, this setup favors tactical longs on intraday declines, with tight stop-loss placement below 57,600. Setup 3 — Nifty Call Options Data Analysis:Aggressive call writing above 26,000 indicates cautious optimism — traders are booking gains near upper levels. The 26,200–26,500 range may act as a short-term ceiling unless fresh momentum emerges. Setup 4 — Nifty Put Options Data Analysis:Active Put writing around 26,000 shows confidence among buyers. As long as these strikes hold, the broader sentiment remains constructive, even amid mild corrections. Setup 5 — Bank Nifty Call Options Data Analysis:Call writers are defending 58,500–58,800, signaling potential near-term resistance. A breakout above this zone could lead to short-covering, propelling prices toward 59,500–60,000. Setup 6 — Bank Nifty Put Options Data Analysis:Put writers remain active near 58,000 — a sign of confidence that the index will not see a deep correction in the immediate term. Setup 7 — Volatility Index (India VIX) India VIX: 11.73 (+3.85%) The VIX rose modestly, reflecting a slight uptick in uncertainty after a smooth rally. While current levels remain manageable, traders should be cautious if volatility sustains above 13–14 in the coming sessions. As dhwani patel emphasizes,“Volatility doesn’t end bull markets — it just resets trader confidence.” Setup 8 — Sectoral Rotation Watch For swing trading strategies India, aligning with sectoral leadership continues to offer the best risk-reward setups. Setup 9 — Intraday Trade Plan Index Bullish Above Bearish Below Neutral Zone Nifty 50 26,045 25,803 25,850–26,000 Bank Nifty 58,589 57,815 58,000–58,400 Strategy: Setup 10 — dhwani patel’s View “After a sustained run, short-term profit booking is natural — but trend traders should not confuse pauses with reversals. As long as Nifty stays above 25,800 and Bank Nifty above 57,800, the market retains its bullish tone.” The Trade Setup for 24 October 2025 signals consolidation within strength. Momentum remains intact, and dips continue to offer opportunities to align with the broader trend. Key Takeaways Final Thoughts The market is digesting its gains — not reversing. Traders should focus on managing exposure, protecting profits, and letting the trend evolve naturally. As dhwani patel aptly says — “The best traders don’t chase moves — they prepare for them. Control your risk; the market will handle the rest.” Disclosure & Disclaimer: dhwani patel (SEBI Registration No. INH200008608) is a SEBI registered research analyst. The information provided is for educational purposes only and does not constitute investment or trading advice. Trading in financial markets carries risk. Readers should perform their own analysis.