Market Outlook

After a volatile start to November, Indian equities are hovering near critical support zones. The Nifty 50 has been consolidating below 25,600, and momentum indicators hint at short-term range-bound action.

This environment is ideal for swing traders, where selective stock-specific strength offers high-probability opportunities.

Below are five top swing trading stocks chosen for the week based on price action, volume surge, RSI, MACD, and short-term momentum.

1. Alpex Solar Ltd (CMP ₹ 1,280)

Setup: A strong uptrend continues after a brief consolidation. Price has retested its breakout zone near ₹1,250 and bounced sharply on rising volume.

- Entry Zone: ₹ 1,260 – 1,285

- Stop-Loss: ₹ 1,190

- Targets: ₹ 1,350 / 1,410

- Reasoning: RSI trending above 60 with strong volume support. Clean higher-high pattern visible on the daily chart.

- Bias: Bullish continuation

2. Banco Products India Ltd (CMP ₹ 798)

Setup: The stock has broken a short-term falling channel and now trades above its 20- and 50-day EMAs.

- Entry Zone: ₹ 790 – 810

- Stop-Loss: ₹ 755

- Targets: ₹ 850 / 880

- Reasoning: Quarterly profit growth + strong ROCE of 32%. Positive divergence on MACD indicates renewed buying interest.

- Bias: Bullish reversal

3. Cemindia Project Ltd (CMP ₹ 856)

Setup: Price has been consolidating for 10 days and is now showing an upward breakout with 9% rise in ROCE.

- Entry Zone: ₹ 850 – 870

- Stop-Loss: ₹ 810

- Targets: ₹ 920 / 950

- Reasoning: Consistent quarterly profit (+49%) and strong delivery volume support the move.

- Bias: Accumulation breakout

4. Asian Paints Ltd (CMP ₹ 2,613)

Setup: After multiple tests near ₹ 2,570 support, the stock has formed a bullish hammer pattern.

- Entry Zone: ₹ 2,600 – 2,625

- Stop-Loss: ₹ 2,540

- Targets: ₹ 2,700 / 2,760

- Reasoning: Defensive stock with relative strength outperforming Nifty FMCG. RSI > 55 and MACD turning positive.

- Bias: Bullish rebound

5. Knowledge Marine & Engineering Works (CMP ₹ 2,678)

Setup: Recently completed a flag pattern breakout above ₹ 2,600 with healthy volumes.

- Entry Zone: ₹ 2,660 – 2,690

- Stop-Loss: ₹ 2,580

- Targets: ₹ 2,780 / 2,850

- Reasoning: Low debt, 64 P/E, 12% Qtr Sales Var % and strong order visibility make this an ideal short-term pick.

- Bias: Bullish continuation

Bonus Watchlist Stocks

- Lumax Auto Tech: Recovery from oversold zone with RSI crossing 45.

- Britannia Industries: Range bound but can offer a swing move above ₹ 6,220.

- Vedanta Ltd: Metal theme revival may trigger short-term bounce above ₹ 525.

Strategy for the Week

- Focus on short-term momentum rather than sectoral themes.

- Maintain strict stop-losses as volatility may spike ahead of mid-month events.

- Book profits partially near targets.

- Re-enter only on confirmation candles.

Dhwani Patel’s Swing Trading Insights

“Discipline is the edge in swing trading — a clear plan, tight risk control, and objective exit levels define success. Traders should focus on stocks with consistent volume confirmation and breakout patterns.”

Key Takeaways

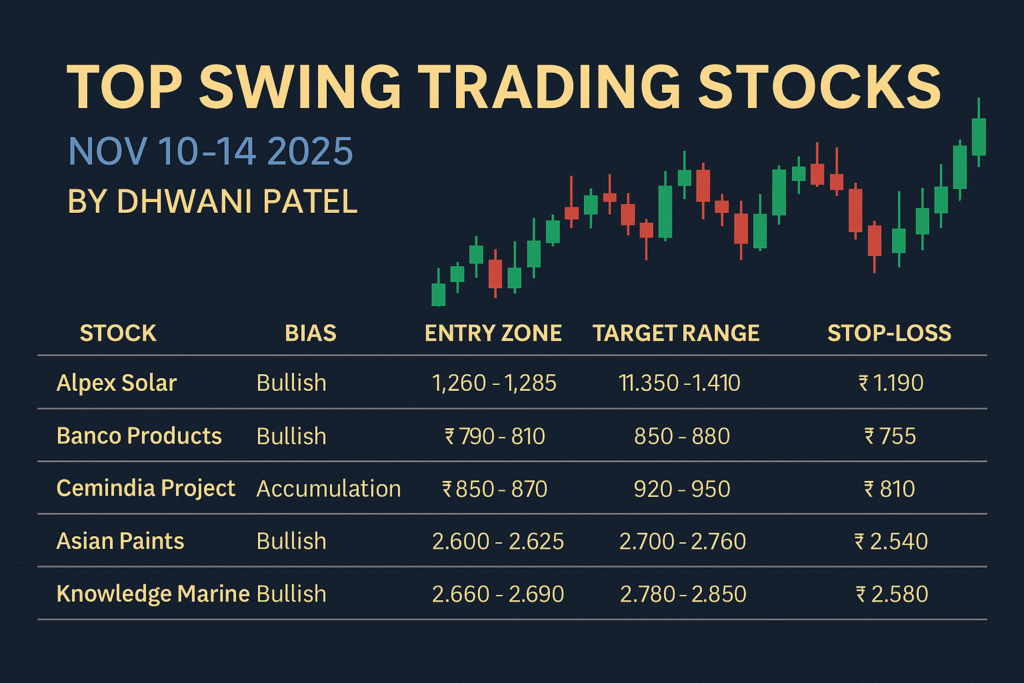

| Stock | Bias | Entry Zone | Target Range | Stop-Loss |

|---|---|---|---|---|

| Alpex Solar | Bullish Continuation | ₹ 1,260–1,285 | ₹ 1,350–1,410 | ₹ 1,190 |

| Banco Products | Bullish Reversal | ₹ 790–810 | ₹ 850–880 | ₹ 755 |

| Cemindia Project | Accumulation Breakout | ₹ 850–870 | ₹ 920–950 | ₹ 810 |

| Asian Paints | Bullish Rebound | ₹ 2,600–2,625 | ₹ 2,700–2,760 | ₹ 2,540 |

| Knowledge Marine | Bullish Continuation | ₹ 2,660–2,690 | ₹ 2,780–2,850 | ₹ 2,580 |

Disclosure & Disclaimer: Dhwani Patel (SEBI Registration No: INH200008608) is a SEBI-registered Research Analyst.

The information above is for educational and informational purposes only and does not constitute investment advice.

Trading in securities involves risk of loss; consult your financial advisor before acting on any recommendation.